Page 24 - Insurance Times March 2021

P. 24

It also achieved a 57 percent increase in accuracy in fraud through a fraud detection algorithm before sending wire

detection from the previous year. From fraud detection to instructions to the bank to pay for the claim settlement.

underwriting, AI technologies are reimagining every facet

of APAC's booming insurance industry. By reducing the risks Advanced underwriting:

and streamlining processes, it can help companies drive

IoT and tracking devices yield an explosion of valuable data

efficiencies and deliver more personalized products and which can be utilized to make the process of determining

services - the key to future success.

insurance premium upright and regulated. Fitness and

vehicle tracking system in both health and auto insurance

From smart chatbots that offer quick customer service round sector give rise to the dynamic, intelligent underwriting

the clock to the array of machine learning technologies that

algorithms that cleverly control the way premium is

spruce up the functioning of any workplace through its

dictated. Using Artificial Intelligence and Machine Learning,

automation power, the expanding potential of Artificial insurers can save a lot of time and resources involved in

Intelligence in Insurance is already being used in many ways, underwriting process and tedious questions and surveys, and

as covered in our last blog. With increased awareness and automate the process. Insurance bots can automatically

resources about the game-changing influence of AI in the

explore a customer's general economy and social profile to

Insurance industry, the initial hesitations and shallow

determine their living patterns, lifestyle, risk factors and

discomfort around the its implementation are now fading

financial stability.

quickly as it begins to trust in the caliber and numerous

opportunities brought forward by Artificial Intelligence and Customers who are more regular in their financial patterns

Machine Learning.

are qualified to feel safe through low premiums. Since AI is

more capable of strict scrutiny of gathered data, it can

The only question that remains is - how far can we push its predict the amount of risk involved, protect companies from

capabilities? AI-based chatbots can be implemented to frauds and give justified insurance amount to customers.

improve the current status of claim process run by multiple MetroMile, a US-based start-up, has established such

employees. Driven by Artificial Intelligence, touchless dynamic underwriting system known as 'pay-per-mile' where

insurance claim process can remove excessive human

usage of a car determines insurance premium. Here, an AI-

intervention and can report the claim, capture damage,

based device installed on the vehicle by the company uses a

update the system and communicate with the customer all special algorithm to monitor miles, jerks, collisions and

by itself. Such effortless process will have clients filing their frictions, speed patterns and other car struggles on the

claims without much hassle for e.g. an AI-powered claims road, and it collects detailed data essential to decide

bot can review the claim, verify policy details and pass it

whether or not drivers deserve low premiums.

The process of underwriting is often

viewed as an art based on personal

judgment, but AI technologies have

also worked their way into this area of

insurance, making the process

increasingly scientific. Insurers are now

using advanced analytics and machine

learning, as well as additional sources

such as satellites and the Internet of

Things devices, to help get a more

holistic view of risk, as well as to

determine which submissions to

review in the first place. Japanese

insurance firm Fukuoka Mutual, for

instance, has been using a cognitive

machine learning based system to

scan medical records and data on

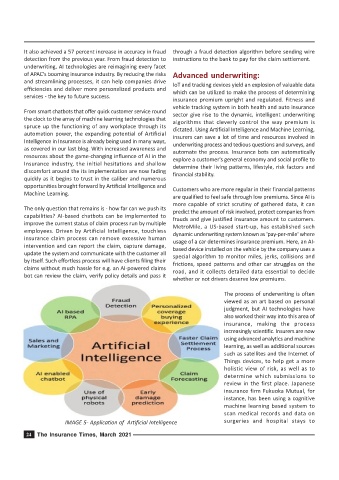

IMAGE 5- Application of Artificial Intelligence surgeries and hospital stays to

24 The Insurance Times, March 2021