Page 17 - RMAI BULLETIN Jan - Mar 2020

P. 17

RMAI BULLETIN JANUARY TO MARCH 2020

Continued from last issue

RISK MANAGEMENT

SYSTEM MUST

PREVAIL IN INDIAN

INSURERS’ MARKET

Anabil Bhattacharya

OPERATIONS Risk Inspecting Engineer & Insurance Counselor,

B.M.E. (Honours), F.I.I.I.,

E National Insurance Co. Ltd., KOLKATA.

Retired Chief Manager, H.O.,

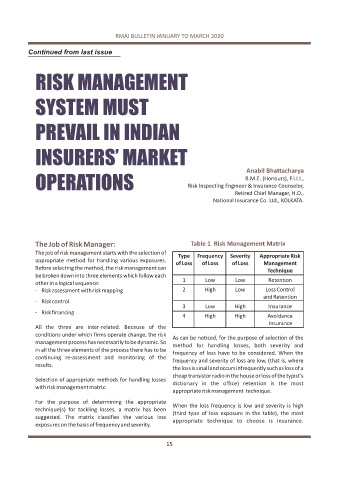

E TheJobofRiskManager: Table 1 Risk Management Matrix

The job of risk management starts with the selection of

Type

appropriate method for handling various exposures.

ofLoss Frequency Severity AppropriateRisk

ofLoss

ofLoss

Management

Before selecting the method, the risk management can

Technique

be broken down into three elements which follow each

1 Low Low Retention

otherinalogicalsequence:

- Riskassessmentwithriskmapping 2 High Low LossControl

andRetention

- Riskcontrol

3 Low High Insurance

- Riskfinancing

4 High High Avoidance

Insurance

All the three are inter-related. Because of the

conditions under which firms operate change, the risk

As can be noticed, for the purpose of selection of the

managementprocesshasnecessarilytobedynamic.So method for handling losses, both severity and

in all the three elements of the process there has to be

frequency of loss have to be considered. When the

continuing re-assessment and monitoring of the

frequency and severity of loss are low, (that is, where

results.

thelossissmallandoccursinfrequentlysuchaslossofa

cheaptransistorradiointhehouseorlossofthetypist’s

Selection of appropriate methods for handling losses

dictionary in the office) retention is the most

withriskmanagementmatrix:

appropriateriskmanagement technique.

For the purpose of determining the appropriate

When the loss frequency is low and severity is high

technique(s) for tackling losses, a matrix has been

(third type of loss exposure in the table), the most

suggested. The matrix classifies the various loss

appropriate technique to choose is insurance.

exposuresonthebasisoffrequencyandseverity.

15