Page 50 - The Insurance Times July 2025

P. 50

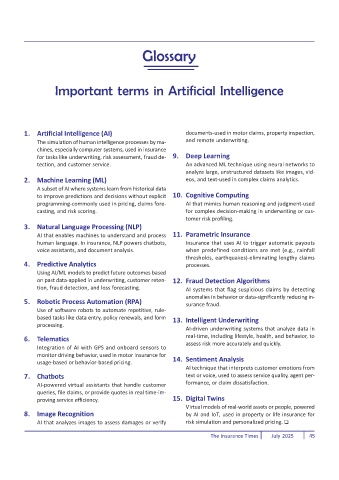

Glossary

Important terms in Artificial Intelligence

1. Artificial Intelligence (AI) documents-used in motor claims, property inspection,

The simulation of human intelligence processes by ma- and remote underwriting.

chines, especially computer systems, used in insurance

for tasks like underwriting, risk assessment, fraud de- 9. Deep Learning

tection, and customer service. An advanced ML technique using neural networks to

analyze large, unstructured datasets like images, vid-

2. Machine Learning (ML) eos, and text-used in complex claims analytics.

A subset of AI where systems learn from historical data

to improve predictions and decisions without explicit 10. Cognitive Computing

programming-commonly used in pricing, claims fore- AI that mimics human reasoning and judgment-used

casting, and risk scoring. for complex decision-making in underwriting or cus-

tomer risk profiling.

3. Natural Language Processing (NLP)

AI that enables machines to understand and process 11. Parametric Insurance

human language. In insurance, NLP powers chatbots, Insurance that uses AI to trigger automatic payouts

voice assistants, and document analysis. when predefined conditions are met (e.g., rainfall

thresholds, earthquakes)-eliminating lengthy claims

4. Predictive Analytics processes.

Using AI/ML models to predict future outcomes based

on past data-applied in underwriting, customer reten- 12. Fraud Detection Algorithms

tion, fraud detection, and loss forecasting. AI systems that flag suspicious claims by detecting

anomalies in behavior or data-significantly reducing in-

5. Robotic Process Automation (RPA) surance fraud.

Use of software robots to automate repetitive, rule-

based tasks like data entry, policy renewals, and form 13. Intelligent Underwriting

processing.

AI-driven underwriting systems that analyze data in

real-time, including lifestyle, health, and behavior, to

6. Telematics

assess risk more accurately and quickly.

Integration of AI with GPS and onboard sensors to

monitor driving behavior, used in motor insurance for

usage-based or behavior-based pricing. 14. Sentiment Analysis

AI technique that interprets customer emotions from

7. Chatbots text or voice, used to assess service quality, agent per-

AI-powered virtual assistants that handle customer formance, or claim dissatisfaction.

queries, file claims, or provide quotes in real time-im-

proving service efficiency. 15. Digital Twins

Virtual models of real-world assets or people, powered

8. Image Recognition by AI and IoT, used in property or life insurance for

AI that analyzes images to assess damages or verify risk simulation and personalized pricing.

The Insurance Times July 2025 45