Page 59 - Insurance Times November 2022

P. 59

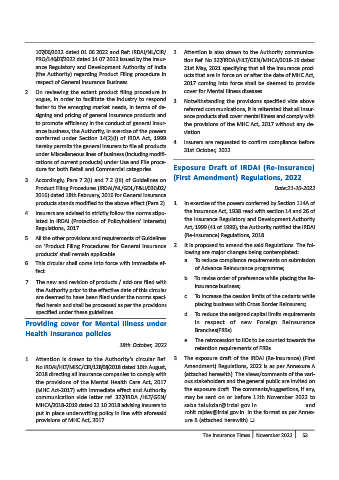

107/06/2022 dated 01.06.2022 and Ref: IRDAI/NL/CIR/ 2. Attention is also drawn to the Authority communica-

PRO/146/07/2022 dated 14.07.2022 issued by the Insur- tion Ref. No.327/IRDAI/HLT/GEN/MHCA/2018-19 dated

ance Regulatory and Development Authority of India 21st May, 2021 specifying that all the insurance prod-

(the Authority) regarding Product Filing procedure in ucts that are in force on or after the date of MHC Act,

respect of General Insurance Business.

2017 coming into force shall be deemed to provide

2. On reviewing the extant product filing procedure in cover for Mental Illness diseases.

vogue, in order to facilitate the industry to respond

3. Notwithstanding the provisions specified vide above

faster to the emerging market needs, in terms of de-

referred communications, it is reiterated that all insur-

signing and pricing of general insurance products and

ance products shall cover mental illness and comply with

to promote efficiency in the conduct of general insur- the provisions of the MHC Act, 2017 without any de-

ance business, the Authority, in exercise of the powers

viation.

conferred under Section 14(2)(i) of IRDA Act, 1999

4. Insurers are requested to confirm compliance before

hereby permits the general insurers to file all products

31st October, 2022.

under Miscellaneous lines of business (including modifi-

cations of current products) under Use and File proce-

Exposure Draft of IRDAI (Re-insurance)

dure for both Retail and Commercial categories.

(First Amendment) Regulations, 2022

3. Accordingly, Para 7.2(I) and 7.2 (III) of Guidelines on

Product Filing Procedures (IRDAI/NL/GDL/F&U/030/02/ Date:21-10-2022

2016) dated 18th February, 2016 for General Insurance

products stands modified to the above effect (Para 2). 1. In exercise of the powers conferred by Section 114A of

the Insurance Act, 1938 read with section 14 and 26 of

4. Insurers are advised to strictly follow the norms stipu-

the Insurance Regulatory and Development Authority

lated in IRDAI (Protection of Policyholders’ Interests)

Act, 1999 (41 of 1999), the Authority notified the IRDAI

Regulations, 2017.

(Re-insurance) Regulations, 2018.

5. All the other provisions and requirements of Guidelines

2. It is proposed to amend the said Regulations. The fol-

on ‘Product Filing Procedures for General Insurance

lowing are major changes being contemplated:

products’ shall remain applicable.

a. To reduce compliance requirements on submission

6. This circular shall come into force with immediate ef-

of Advance Reinsurance programme;

fect.

b. To revise order of preference while placing the Re-

7. The new and revision of products / add-ons filed with

insurance business;

the Authority prior to the effective date of this circular

are deemed to have been filed under the norms speci- c. To increase the cession limits of the cedants while

fied herein and shall be processed as per the provisions placing business with Cross Border Reinsurers;

specified under these guidelines.

d. To reduce the assigned capital limits requirements

in respect of new Foreign Reinsurance

Providing cover for Mental Illness under

Branches(FRBs)

Health Insurance policies

e. The retrocession to IIOs to be counted towards the

18th October, 2022

retention requirements of FRBs

3. The exposure draft of the IRDAI (Re-insurance) (First

1. Attention is drawn to the Authority’s circular Ref.

Amendment) Regulations, 2022 is as per Annexure A

No.IRDAI/HLT/MISC/CIR/128/08/2018 dated 16th August,

2018 directing all Insurance companies to comply with (attached herewith). The views/comments of the vari-

the provisions of the Mental Health Care Act, 2017 ous stakeholders and the general public are invited on

(MHC Act-2017) with immediate effect and Authority the exposure draft. The comments/suggestions, if any,

communication vide letter ref. 327/IRDA /HLT/GEN/ may be sent on or before 11th November 2022 to

MHCA/2018-2019 dated 22.10.2018 advising Insurers to saba.talukdar@irdai.gov.in and

put in place underwriting policy in line with aforesaid rohit.rajdev@irdai.gov.in in the format as per Annex-

provisions of MHC Act, 2017. ure B (attached herewith).

The Insurance Times November 2022 53