Page 40 - Banking Finance August 2023

P. 40

FEATURES

proximity of a physical bank branch authenticates the sta- have opened 480 and 240 branches, respectively, in FY23.

bility and availability of their bank. These private banks are proactively expanding their physi-

cal footprint in Tier 2 cities and rural areas, with a specific

During a crisis, customers long for familiarity and certainty, focus on serving the salaried class, farmers, and small busi-

and trusting intangible assets becomes highly challenging. nesses.

For this class of customers, branches act as ambassadors and

provide tangible proof of real relationship banking beyond

New avatar

a screen. Branches are also seen as important nodal points

Although many branches have been closed in India's post-

for resolving cus-

nationalisation

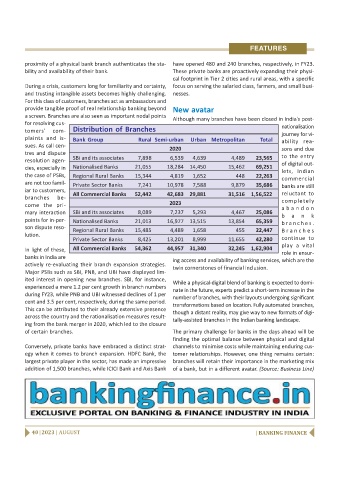

tomers' com- Distribution of Branches

journey for vi-

plaints and is-

Bank Group Rural Semi-urban Urban Metropolitan Total

ability rea-

sues. As call cen-

2020 sons and due

tres and dispute

SBi and its associates 7,898 6,539 4,639 4,489 23,565 to the entry

resolution agen-

of digital out-

cies, especially in Nationalised Banks 21,055 18,284 14,450 15,462 69,251

lets, Indian

the case of PSBs, Regional Rural Banks 15,344 4,819 1,652 448 22,263

commercial

are not too famil-

Private Sector Banks 7,241 10,978 7,588 9,879 35,686 banks are still

iar to customers,

All Commercial Banks 52,442 42,683 29,881 31,516 1,56,522 reluctant to

branches be-

completely

2023

come the pri-

a b a n d o n

mary interaction SBi and its associates 8,089 7,237 5,293 4,467 25,086

b a n k

points for in-per- Nationalised Banks 21,013 16,977 13,515 13,854 65,359

b r a n c h e s .

son dispute reso-

Regional Rural Banks 15,485 4,489 1,658 455 22,447 B r a n c h e s

lution.

Private Sector Banks 8,425 13,201 8,999 11,655 42,280 continue to

play a vital

In light of these, All Commercial Banks 54,362 44,957 31,340 32,245 1,62,904

role in ensur-

banks in India are

ing access and availability of banking services, which are the

actively re-evaluating their branch expansion strategies.

twin cornerstones of financial inclusion.

Major PSBs such as SBI, PNB, and UBI have displayed lim-

ited interest in opening new branches. SBI, for instance,

While a physical-digital blend of banking is expected to domi-

experienced a mere 1.2 per cent growth in branch numbers

nate in the future, experts predict a short-term increase in the

during FY23, while PNB and UBI witnessed declines of 1 per

number of branches, with their layouts undergoing significant

cent and 3.5 per cent, respectively, during the same period.

transformations based on location. Fully automated branches,

This can be attributed to their already extensive presence

though a distant reality, may give way to new formats of digi-

across the country and the rationalisation measures result-

tally-assisted branches in the Indian banking landscape.

ing from the bank merger in 2020, which led to the closure

of certain branches. The primary challenge for banks in the days ahead will be

finding the optimal balance between physical and digital

Conversely, private banks have embraced a distinct strat- channels to minimise costs while maintaining enduring cus-

egy when it comes to branch expansion. HDFC Bank, the tomer relationships. However, one thing remains certain:

largest private player in the sector, has made an impressive branches will retain their importance in the marketing mix

addition of 1,500 branches, while ICICI Bank and Axis Bank of a bank, but in a different avatar. (Source: Business Line)

40 | 2023 | AUGUST | BANKING FINANCE