Page 16 - Marine Insurance IC67 EBOOK

P. 16

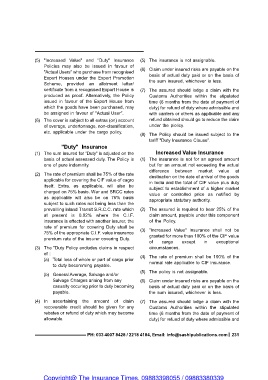

(5) "Increased Value" and "Duty" Insurance (5) The insurance is not assignable.

Policies may also be issued in favour of

"Actual Users" who purchase from recognised (6) Claim under insured risks are payable on the

Export Houses under the Export Promotion basis of actual duty paid or on the basis of

Scheme, provided an allotment letter/ the sum insured, whichever is less.

certificate from a recognised Export House is

produced as proof. Alternatively, the Policy (7) The assured should lodge a claim with the

issued in favour of the Export House from Customs Authorities within the stipulated

which the goods have been purchased, may time (6 months from the date of payment of

be assigned in favour of "Actual User". duty) for refund of duty where admissible and

with carriers or others as applicable and any

(6) The cover is subject to all extras (on) account refund obtained should go to reduce the claim

of overage, undertonnage, non-classification, under the piolicy.

etc. applicable under the cargo policy.

(8) The Policy should be issued subject to the

"Duty" Insurance tariff "Duty Insurance Clause".

(1) The sum insured for "Duty" is adjusted on the Increased Value Insurance

basis of actual assessed duty. The Policy is

one of pure indemnity. (1) The insurance is not for an agreed amount

but for an amount not exceeding the actual

(2) The rate of premium shall be 75% of the rate difference between market value at

applicable for covering the CIF value of cagro destination on the date of arrival of the goods

itself. Extra, as applicable, will also be in India and the total of CIF value plus duty

charged on 75% basis. War and SRCC rates subject to establishment of a higher market

as applicable will also be on 75% basis value or controlled price as notified by

subject to such rates not being less than the appropriate statutory authority.

prevailling inland Transit S.R.C.C. rate which

at present is 0.02% where the C.I.F. (2) The assured is required to bear 25% of the

insurance is effected with another insurer, the claim amount, payable under this component

rate of premium for covering Duty shall be of the Policy.

75% of the appropriate C.I.F. value insurance

premium rate of the insurer covering Duty. (3) "Increased Value" Insurance shall not be

granted for more than 100% of the CIF value

(3) The "Duty Policy excludes claims in respect of cargo except in exceptional

of : circumstances.

(a) Total loss of whole or part of cargo prior

to duty becomming payable. (4) The rate of premium shall be 100% of the

normal rate applicable to CIF insurance.

(b) General Average, Salvage and/or

Salvage Charges arising from any (5) The policy is not assignable.

casualty occuring prior to duty becoming

payable. (6) Claim under insured risks are payable on the

basis of actual duty paid or on the basis of

(4) In ascertaining the amount of claim the sum insured, whichever is less.

recoverable credit should be given for any

rebates or refund of duty which may become (7) The assured should lodge a claim with the

allowable. Customs Authorities within the stipulated

time (6 months from the date of payment of

duty) for refund of duty where admissible and

PH: 033 4007 8428 / 2218 4184, Email: info@sashipublications.com 231