Page 14 - Marine Insurance IC67 EBOOK

P. 14

charged and then the SDP discount should be policy the same cannot be converted into a

granted. Special Declaration Policy retrospectively.

Discount in premium rate where loss ratio is less (iii) Turnover discount will be granted on expiry of

than 60%. the policy retrospectively provided claim ratio

does not exceed 60%.

If the claim ratio for the three years excluding Open Cover

immediately preceding year is less than 60% then

the following discount is applied on the total rate. For clients engaged in substantial international

trade import/export goods and having substantial

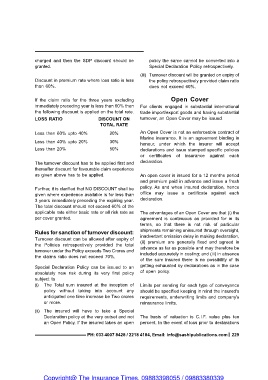

LOSS RATIO DISCOUNT ON turnover, an Open Cover may be issued.

TOTAL RATE

An Open Cover is not an enforceable contract of

Less than 60% upto 40% 20% Marine insurance. It is an agreement binding in

honour, under which the insurer will accept

Less than 40% upto 20% 30% declarations and issue stamped specific policies

Less than 20% 50% or certificates of insurance against each

declaration.

The turnover discount has to be applied first and

thereafter discount for favourable claim experience An open cover is issued for a 12 months period

as given above has to be applied. and premium paid in advance and issue a fresh

policy. As and when insured declaration, hence

Further, it is clarified that NO DISCOUNT shall be office may issue a certificate against each

given where experience available is for less than declaration.

3 years immediately preceding the expiring year.

The total discount should not exceed 60% of the The advantages of an Open Cover are that (i) the

applicable rate either basic rate or all risk rate as agreement is continuous as provided for in its

per cover granted. terms, so that there is not risk of particular

shipments remaining uninsured through oversight,

Rules for sanction of turnover discount: inadvertant omission delay in making declaration,

(ii) premium are generally fixed and agreed in

Turnover discount can be allowed after expiry of advance as far as possible and may therefore be

the Policies retrospectively provided the total included accurately in costing; and (iii) in absence

turnover under the Policy exceeds Two Crores and of the sum insured there is no possibility of its

the claims ratio does not exceed 70%. getting exhausted by declarations as in the case

of open policy.

Special Declaration Policy can be issued to an

absolutely new risk during its very first policy Limits per sending for each type of conveyance

subject to should be specified keeping in mind the insured's

(i) The Total sum insured at the inception of requirements, underwriting limits and company's

reinsurance limits.

policy without taking into account any

anticipated one time increase be Two crores The basis of valuation is C.I.F. value plus ten

or more. percent. In the event of loss prior to declarations

(ii) The insured will have to take a Special

Declaration policy at the very outset and not

an Open Policy. If the insured takes an open

PH: 033 4007 8428 / 2218 4184, Email: info@sashipublications.com 229