Page 13 - LIFE INSURANCE TODAY Novemver 2017

P. 13

gible and maximum sum assured is Rs 3 lakh or equiva- Y The insurant can take loan by pledging his/her policy

lent to the sum assured of the main policy holder to Heads of the Circle/Region on behalf of President

which ever is less. of India, provided the policy has completed 3 years in

Y The main policy holder should not have attained the case of Endowment Assurance and 4 years in case of

age of 45 years. Whole Life Assurance. The facility of assignment is also

Y No premium is required to be paid on the children available.

policy on the death of the main policy holder and full Y Assignment of Policy to any Financial Institution for

sum assured with the accrued bonus shall be paid to taking loan.

the child after the completion of the term of the chil-

Y Revival of his/her lapsed policy. Policy lapses after 6

dren policy. On the death of the child/children, full sum unpaid premiums if it remained in force for less than

assured with the accrued bonus shall be payable to the 3 years and after 12 unpaid premiums if it remained

main policy holder.

in force for more than 3 years.

Y Main policy holder shall be responsible for payments

Y Issue of Duplicate Policy Bond in case of the original

for the Children Policy. No loan shall be admissible on Policy Bond is lost, burnt/torn/mutilation.

Children Policy. However, the policy shall have facility

Y Conversion from Whole Life Assurance to Endowment

for making it paid up provided the premia are paid con-

Assurance and from Endowment Assurance to other

tinuously for 5 years.

Endowment Assurance as per rules.

Y No Medical examination of the Child is necessary.

However, the child should be healthy on the day of Statistics

proposal and the risk shall start from the date of ac-

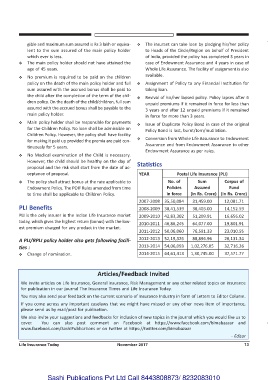

ceptance of proposal. YEAR Postal Life Insurance (PLI)

Y The policy shall attract bonus at the rate applicable to No. of Sum Corpus of

Endowment Policy. The POIF Rules amended from time Policies Assured Fund

to time shall be applicable to Children Policy. in force (in Rs. Crore) (in Rs. Crore)

2007-2008 35,50,084 31,459.00 12,081.71

PLI Benefits 2008-2009 38,41,539 38,403.00 14,152.59

PLI is the only insurer in the Indian Life Insurance market 2009-2010 42,83,302 51,209.91 16,656.02

today, which gives the highest return (bonus) with the low-

2010-2011 46,86,245 64,077.00 19,801.91

est premium charged for any product in the market.

2011-2012 50,06,060 76,591.33 23,010.55

A PLI/RPLI policy holder also gets following facili- 2012-2013 52,19,326 88,896.96 26,131.34

ties : 2013-2014 54,06,093 1,02,276.05 32,716.26

Y Change of nomination. 2014-2015 64,61,413 1,30,745.00 37,571.77

Articles/Feedback Invited

We invite articles on Life Insurance, General insurance, Risk Management or any other related topics on insurance

for publication in our journal The Insurance Times and Life Insurance Today.

You may also send your feedback on the current scenario of Insurance Industry in form of Letters to Editor Column.

If you come across any important caselaws that we might have missed or any other news item of importance,

please send us by mail/post for publication.

We also invite your suggestions and feedbacks for inclusion of new topics in the journal which you would like us to

cover. You can also post comment on Facebook at https://www.facebook.com/bimabazaar and

www.facebook.com/SashiPublications or on twitter at https://twitter.com/bimabazaar

- Editor

Life Insurance Today November 2017 13

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010