Page 23 - Life Insurance Today March 2018

P. 23

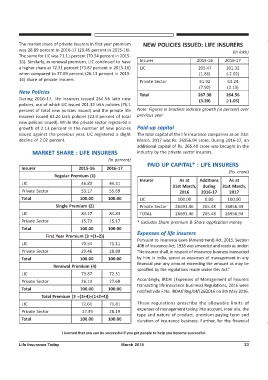

The market share of private insurers in first year premium NEW POLICIES ISSUED: LIFE INSURERS

was 28.89 percent in 2016-17 (29.46 percent in 2015-16).

(In lakh)

The same for LIC was 71.11 percent (70.54 percent in 2015-

16). Similarly, in renewal premium, LIC continued to have Insurer 2015-16 2016-17

a higher share at 72.31 percent (73.87 percent in 2015-16) LIC 205.47 201.32

when compared to 27.69 percent (26.13 percent in 2015- (1.86) (-2.02)

16) share of private insurers. Private Sector 61.92 63.24

(7.92) (2.13)

New Policies

Total 267.38 264.56

During 2016-17, life insurers issued 264.56 lakh new (3.20) (-1.05)

policies, out of which LIC issued 201.32 lakh policies (76.1

percent of total new policies issued) and the private life Note: Figures in brackets indicate growth (in percent) over

insurers issued 63.24 lakh policies (23.9 percent of total previous year

new policies issued). While the private sector registered a

growth of 2.13 percent in the number of new policies Paid-up capital

issued against the previous year, LIC registered a slight The total capital of the life insurance companies as on 31st

decline of 2.02 percent. March, 2017 was Rs. 26956.94 crore. During 2016-17, an

additional capital of Rs. 265.48 crore was brought in the

MARKET SHARE : LIFE INSURERS industry by the private sector insurers.

(in percent)

PAID UP CAPITAL* : LIFE INSURERS

Insurer 2015-16 2016-17

(Rs. crore)

Regular Premium (1)

Insurer As at Additions As at

LIC 46.83 44.31

31st March, during 31st March,

Private Sector 53.17 55.69 2016 2016-17 2017

Total 100.00 100.00 LIC 100.00 0.00 100.00

Single Premium (2) Private Sector 26591.46 265.48 26856.94

LIC 84.27 84.83 TOTAL 26691.46 265.48 26956.94

Private Sector 15.73 15.17 * Excludes Share premium & Share application money

Total 100.00 100.00

Expenses of life insurers

First Year Premium (3 =(1+2))

Pursuant to Insurance Laws (Amendment) Act, 2015, Section

LIC 70.54 71.11

40B of Insurance Act, 1938 was amended and reads as under:

Private Sector 29.46 28.89 “No insurer shall, in respect of insurance business transacted

Total 100.00 100.00 by him in India, spend as expenses of management in any

financial year any amount exceeding the amount as may be

Renewal Premium (4)

specified by the regulations made under this Act.”

LIC 73.87 72.31

Accordingly, IRDAI (Expenses of Management of Insurers

Private Sector 26.13 27.69

transacting life insurance business) Regulations, 2016 were

Total 100.00 100.00

notified vide F.No. IRDAI/ Reg/14/126/2016 on 9th May 2016.

Total Premium (5 =(3+4)=(1+2+4))

LIC 72.61 71.81 These regulations prescribe the allowable limits of

expenses of management taking into account, inter alia, the

Private Sector 27.39 28.19

type and nature of product, premium paying term and

Total 100.00 100.00 duration of insurance business. Further, for the financial

I learned that you can be successful if you get people to help you become successful.

Life Insurance Today March 2018 23