Page 28 - Life Insurance Today March 2018

P. 28

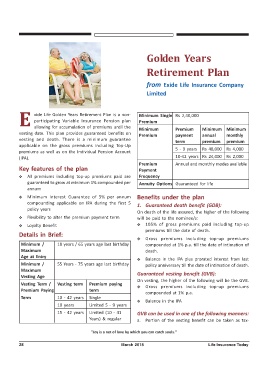

Golden Years

Retirement Plan

from Exide Life Insurance Company

Limited

E xide Life Golden Years Retirement Plan is a non- Minimum Single Rs 2,40,000

participating Variable Insurance Pension plan

Premium

allowing for accumulation of premiums until the

Minimum Premium Minimum Minimum

vesting date. This plan provides guaranteed benefits on

Premium payment annual monthly

vesting and death. There is a minimum guarantee

term premium premium

applicable on the gross premiums including Top-Up

premiums as well as on the Individual Pension Account 5 - 9 years Rs 48,000 Rs 4,000

(IPA). 10-42 years Rs 24,000 Rs 2,000

Premium Annual and monthly modes available

Key features of the plan Payment

Y All premiums including top-up premiums paid are Frequency

guaranteed to grow at minimum 1% compounded per Annuity Options Guaranteed for life

annum

Y Minimum Interest Guarantee of 5% per annum Benefits under the plan

compounding applicable on IPA during the first 5

1. Guaranteed death benefit (GDB):

policy years

On death of the life assured, the higher of the following

Y Flexibility to alter the premium payment term will be paid to the nominee/s:

Y Loyalty Benefit Y 105% of gross premiums paid including top-up

premiums till the date of death.

Details in Brief:

Y Gross premiums including top-up premiums

Minimum / 18 years / 65 years age last birthday compounded at 1% p.a. till the date of intimation of

Maximum death.

Age at Entry

Y Balance in the IPA plus prorated interest from last

Minimum / 55 Years - 75 years age last birthday policy anniversary till the date of intimation of death.

Maximum

Guaranteed vesting benefit (GVB):

Vesting Age

On vesting, the higher of the following will be the GVB.

Vesting Term / Vesting term Premium paying

Y Gross premiums including top-up premiums

Premium Paying term

compounded at 1% p.a.

Term 10 - 42 years Single

Y Balance in the IPA

10 years Limited 5 - 9 years

15 - 42 years Limited (10 - 41 GVB can be used in one of the following manners:

Years) & regular a. Portion of the vesting benefit can be taken as tax-

"Joy is a net of love by which you can catch souls."

28 March 2018 Life Insurance Today