Page 29 - Life Insurance Today March 2018

P. 29

free commuted value, as prescribed under section

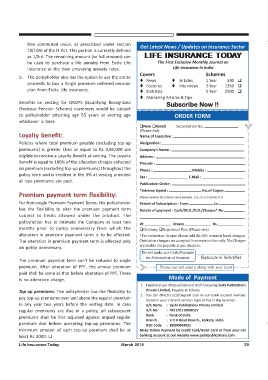

Get Latest News / Updates on Insurance Sector

10(10A) of the IT Act. This portion is currently defined

as 1/3rd. The remaining amount (or full amount) can LIFE INSURANCE TODAY

be used to purchase a life annuity from Exide Life The First Exclusive Monthly Journal on

Insurance at the then prevailing annuity rates. Life Insurance in India

Covers Schemes

b. The policyholder also has the option to use the entire

News Articles 1 Year 540

proceeds to buy a Single premium deferred pension

Features Interviews 3 Year 1350

plan from Exide Life Insurance. Statistics 5 Year 2200

Marketing Articles & Tips

Benefits on vesting for QROPS (Qualifying Recognized Subscribe Now !!

Subscribe Now !!

Subscribe Now !!

Subscribe Now !!

Subscribe Now !!

Overseas Pension Scheme) customers would be subject

to policyholder attaining age 55 years or vesting age ORDER FORM

whichever is later.

New Rental Subscription No.

(Please tick)

Loyalty benefit: Name of Executive :

Policies where total premium payable (excluding top-up Designation:

premiums) is greater than or equal to Rs 4,80,000 are Company's Name :

eligible to receive a Loyalty Benefit at vesting. The Loyalty Address :

Benefit is equal to 100% of the allocation charges collected Pincode :

on premium (excluding top-up premiums) throughout the

Phone : Mobile :

policy term and is credited in the IPA at vesting provided

Fax : E.Mail :

all due premiums are paid.

Publication Order :

*Scheme Opted : No.of Copies

Premium payment term flexibility:

(Please mention the scheme name example : It-1, Lit-1 or Combo 4-1)

For Non-single Premium Payment Terms, the policyholder Period of Subscription : From to

has the flexibility to alter the premium payment term Details of payment : Cash/M.O./D.D./Cheque* No

subject to limits allowed under the product. The

policyholder has to intimate the Company at least two

Dt drawn Rs.

months prior to policy anniversary from which the Ordinary Registered Post (Please tick)

alteration in premium payment term is to be effected. *For outstation cheque please add Rs.50/- towards bank charges.

The alteration in premium payment term is effected only Outstation cheques are accepted from metro cities only. No Charges

applicable for payable at per cheques.

on policy anniversary.

Do not make any Cash Payment

for Subcription of Journals Signature of Subcriber

The premium payment term can't be reduced to single

premium. After alteration of PPT, the annual premium Please tear and send it along with your letter

paid shall be same as that before alteration of PPT. There

is no alteration charge. Mode of Payment

1. Payable at per Cheque/Demand Draft favouring Sashi Pulbications

Top-up premiums: The policyholder has the flexibility to Private Limited, Payable at Kolkata

2. You can directly ECS/Deposit cash in our bank account number

pay top-up premiums over and above the regular premium

below in your city and send us copy of Pay in slip by email.

in any year two years before the vesting date. In case A/C Name : Sashi Publications Private Limited

regular premiums are due in a policy, all subsequent A/C No. : 402120110000327

premiums shall be first adjusted against unpaid regular Bank : Bank of India

Branch : V V K Road Branch., Kolkata, India

premium due before accepting top-up premiums. The IFSC Code : BKID0004021

minimum amount of such top-up premium shall be at Make Online Payment by Credit Card/Debit Card or from your net

least Rs 2000. T banking account at our website www.sashipublications.com

Life Insurance Today March 2018 29