Page 24 - Life Insurance Today March 2018

P. 24

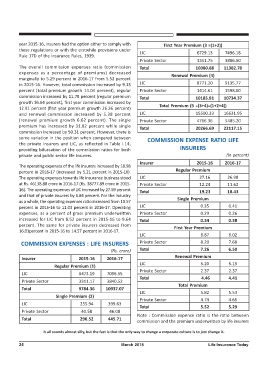

year 2015-16, insurers had the option either to comply with First Year Premium (3 =(1+2))

these regulations or with the erstwhile provisions under LIC 6729.13 7496.18

Rule 17D of the Insurance Rules, 1939.

Private Sector 3351.75 3886.60

The overall commission expenses ratio (commission Total 10080.88 11382.78

expenses as a percentage of premiums) decreased Renewal Premium (4)

marginally to 5.29 percent in 2016-17 from 5.52 percent

in 2015-16. However, total commission increased by 9.13 LIC 8771.20 9135.77

percent (total premium growth 14.04 percent), regular Private Sector 1414.61 1598.60

commission increased by 11.78 percent (regular premium Total 10185.81 10734.37

growth 16.64 percent), first year commission increased by

12.91 percent (first year premium growth 26.26 percent) Total Premium (5 =(3+4)=(1+2+4))

and renewal commission increased by 5.38 percent LIC 15500.33 16631.95

(renewal premium growth 6.62 percent). The single Private Sector 4766.36 5485.20

premium has increased by 31.82 percent while single

Total 20266.69 22117.15

commission increased by 50.31 percent. However, there is

some variation in the position when compared between COMMISSION EXPENSE RATIO LIFE

the private insurers and LIC, as reflected in Table I.14,

providing bifurcation of the commission ratios for both INSURERS

private and public sector life insurers. (In percent)

Insurer 2015-16 2016-17

The operating expenses of the life insurers increased by 18.98

percent in 2016-17 (increased by 5.21 percent in 2015-16). Regular Premium

The operating expenses towards life insurance business stood LIC 27.16 26.98

at Rs. 46138.88 crore in 2016-17 (Rs. 38777.89 crore in 2015- Private Sector 12.24 11.62

16). The operating expenses of LIC increased by 27.59 percent

Total 19.23 18.43

and that of private insurers by 6.84 percent. For the industry

as a whole, the operating expenses ratio increased from 10.57 Single Premium

percent in 2015-16 to 11.03 percent in 2016-17. Operating LIC 0.35 0.41

expenses, as a percent of gross premium underwritten Private Sector 0.29 0.26

increased for LIC from 8.52 percent in 2015-16 to 9.64 Total 0.34 0.38

percent. The same for private insurers decreased from First Year Premium

16.01percent in 2015-16 to 14.57 percent in 2016-17.

LIC 6.87 6.02

COMMISSION EXPENSES : LIFE INSURERS Private Sector 8.20 7.68

(Rs. crore) Total 7.26 6.50

Insurer 2015-16 2016-17 Renewal Premium

LIC 5.20 5.19

Regular Premium (1)

Private Sector 2.37 2.37

LIC 6473.19 7096.55

Total 4.46 4.41

Private Sector 3311.17 3840.52

Total Premium

Total 9784.36 10937.07

LIC 5.82 5.53

Single Premium (2)

Private Sector 4.74 4.65

LIC 255.94 399.63

Total 5.52 5.29

Private Sector 40.58 46.08

Note : Commission expense ratio is the ratio between

Total 296.52 445.71

commission and the premium underwritten by life insurers

It all sounds almost silly, but the fact is that the only way to change a corporate culture is to just change it.

24 March 2018 Life Insurance Today