Page 22 - Life Insurance Today December 2017

P. 22

2. Payment of Premiums : policy and any subsequent premium be not duly paid,

The modes of premium payment allowable are Yearly, this policy shall not be wholly void, but shall subsist as a

Half Yearly, Quarterly or Monthly. Single Premium mode paid-up policy. The Sum Assured on Death shall be reduced

is available for terms from 5 to 10 years. to a sum, called the Death Paid-up Sum Assured. The

Death Paid-Up Sum Assured shall bear the same ratio to

A grace period of two calendar months but not less than

the Sum Assured on Death as the premiums paid bears to

60 days will be allowed for all modes of payments.

the total number of premiums payable.

3. Sample Premium Rates: On the Life Assured's death prior to maturity, the Death

Following are some of the sample premium rates per Rs. Paid-Up Sum Assured shall be payable. On Maturity, total

1000/- Sum Assured: premiums paid less taxes and extra premium, if any, shall

be payable.

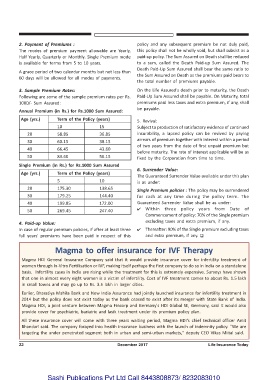

Annual Premium (in Rs.) for Rs.1000 Sum Assured:

Age (yrs.) Term of the Policy (years) 5. Revival:

10 15 Subject to production of satisfactory evidence of continued

20 58.85 36.85 insurability, a lapsed policy can be revived by paying

arrears of premium together with interest within a period

30 60.15 38.15

of two years from the date of first unpaid premium but

40 66.45 43.60

before maturity. The rate of interest applicable will be as

50 83.60 56.15 fixed by the Corporation from time to time.

Single Premium (in Rs.) for Rs.1000 Sum Assured

6. Surrender Value:

Age (yrs.) Term of the Policy (years)

The Guaranteed Surrender Value available under this plan

5 10 is as under:

20 175.30 138.65

Single Premium policies : The policy may be surrendered

30 179.25 144.40 for cash at any time during the policy term. The

40 199.85 172.00 Guaranteed Surrender Value shall be as under:

50 269.45 247.40 Within three policy years from Date of

Commencement of policy: 70% of the Single premium

excluding taxes and extra premium, if any.

4. Paid-up Value:

In case of regular premium policies, if after at least three Thereafter: 90% of the Single premium excluding taxes

full years' premiums have been paid in respect of this and extra premium, if any. T

Magma to offer insurance for IVF Therapy

Magma HDI General Insurance Company said that it would provide insurance cover for infertility treatment of

women through In-Vitro Fertilisation or IVF, making itself perhaps the first company to do so in India on a standalone

basis. Infertility cases in India are rising while the treatment for this is extremely expensive. Surveys have shown

that one in almost every eight women is a victim of infertility. Cost of IVF treatment comes to about Rs. 1.5 lakh

in small towns and may go up to Rs. 3.5 lakh in larger cities.

Earlier, Bharatiya Mahila Bank and New India Assurance had jointly launched insurance for infertility treatment in

2014 but the policy does not exist today as the bank ceased to exist after its merger with State Bank of India.

Magma HDI, a joint venture between Magma Fincorp and Germany's HDI Global SE, Germany, said it would also

provide cover for psychiatric, bariatric and lasik treatment under its premium policy plan.

All these insurance cover will come with three years waiting period, Magma HDI's chief technical officer Amit

Bhandari said. The company forayed into health insurance business with the launch of indemnity policy. "We are

targeting the under penetrated segment both in urban and semi-urban markets," deputy CEO Vikas Miital said.

22 December 2017 Life Insurance Today

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010