Page 27 - Life Insurance Today December 2017

P. 27

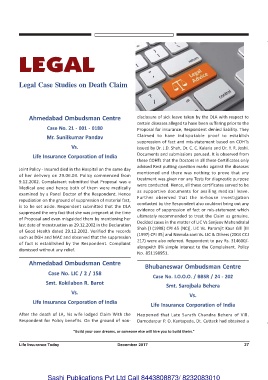

LEGAL

Legal Case Studies on Death Claim

Ahmedabad Ombudsman Centre disclosure of sick leave taken by the DLA with respect to

certain diseases alleged to have been suffering prior to the

Case No. 21 - 001 - 0180 Proposal for insurance, Respondent denied liability. They

Mr. Sunilkumar Pandav Claimed to have indisputable proof to establish

suppression of fact and mis-statement based on COHTs

Vs. issued by Dr. J.D. Shah, Dr. C. C. Kalaria and Dr. Y. R. Joshi.

Life Insurance Corporation of India Documents and submissions perused. It is observed from

these COHTs that the Doctors in all these Certificates only

advised Rest putting question marks against the diseases

Joint Policy - Insured died in the Hospital on the same day

mentioned and there was nothing to prove that any

of her delivery on 29.06.03. Policy commenced from

treatment was given nor any Tests for diagnostic purpose

9.12.2002. Complainant submitted that Proposal was a

were conducted. Hence, all these certificates served to be

Medical one and hence both of them were medically

examined by a Panel Doctor of the Respondent. Hence as supportive documents for availing medical leave.

Further observed that the in-house investigation

repudiation on the ground of suppression of material fact,

conducted by the Respondent also couldnot bring out any

is to be set aside. Respondent submitted that the DLA

suppressed the very fact that she was pregnant at the time evidence of suppression of fact or mis-statement which

ultimately recommended to treat the Claim as genuine.

of Proposal and even misguided them by mentioning her

Decided cases in the matter of LIC Vs Sanjeev Mahendralal

last date of menstruation as 29.12.2002 in the Declaration

Shah [I (1998) CPJ 45 (NC)], LIC Vs. Paramjit Kaur Gill [III

of Good Health dated 29.12.2002. Verified the records

(1997) CPJ 35] and Nirmala soni Vs. LIC & Others (2004 CCJ

such as DGH and MAC and observed that the suppression

217) were also referred. Respondent to pay Rs. 314600/-

of fact is established by the Respondent. Complaint

alongwith 8% simple interest to the Complainant. Policy

dismissed without any relief.

No. 851198951.

Ahmedabad Ombudsman Centre

Bhubaneswar Ombudsman Centre

Case No. LIC / 2 / 158

Case No. I.O.O.O. / BBSR / 24 - 202

Smt. Kokilaben R. Barot

Smt. Sarojbala Behera

Vs.

Vs.

Life Insurance Corporation of India

Life Insurance Corporation of India

After the death of LA, his wife lodged Claim With the Happened that Late Surath Chandra Behera of Vill.

Respondent for Policy benefits. On the ground of non- Damodarpur P. O. Kantapada, Dt. Cuttack had obtained a

“Build your own dreams, or someone else will hire you to build theirs.”

Life Insurance Today December 2017 27

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010