Page 18 - Life Insurance Today OCTOBER 2017

P. 18

sum assured applicable for your spouse shall be equal to the increase in the sum assured to the sum assured

50% of your applicable sum assured. This option shall at inception of the policy and will be reflected from

only be available where the sum assured of primary life the subsequent policy anniversary.

insured is greater than or equal to Rs 60,00,000. You can

choose this option while buying the policy and it shall not The details of Enhanced Lifestage Protection

be changed subsequently. No rider can be opted under are mentioned below:

this option.

Event Enhanced Protection

(% of Sum Assured at Inception of the

Enhanced Lifestage Protection: policy)

Your needs vary at certain times of life, prompting the First Marriage 50% subject to a maximum of

need for greater protection. Your family size grows when Rs. 5,000,000

your children are born, and these events require a higher

Birth of 1st Child 25% subject to a maximum of

coverage to shoulder the additional responsibilities. BSLI

Rs. 2,500,000

Protect@Ease Plan offers enhanced protection for these

Birth of 2nd Child 25% subject to a maximum of

times without any new medical evaluation. Rs. 2,500,000

This feature is available only for Level Term Assurance

Option, where standard life at inception of the policy,

You can choose to reduce the sum assured in future to

regular pay policy and the attained age of life insured

is less than or equal to 50 years. the extent of sum assured increased under the Enhanced

Lifestage Protection option. Any increase in sum assured

His option is not available if Joint Life Protection is due to your first marriage, birth of first child or second

opted for. child under this option, may be subsequently reduced

Future premiums shall be increased in proportion of subject to the written request.

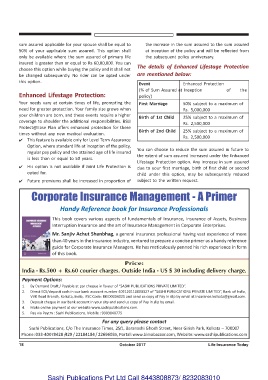

Corporate Insurance Management - A Primer

Handy Reference book for Insurance Professionals

This book covers various aspects of fundamentals of Insurance, Insurance of Assets, Business

Interruption Insurance and the art of Insurance Management in Corporate Enterprises.

Mr. Sanjiv Achut Shanbhag, a general insurance professional having vast experience of more

than 40 years in the insurance industry, ventured to prepare a concise primer as a handy reference

guide for Corporate Insurance Managers. He has meticulously penned his rich experience in form

of this book.

Price:

India - Rs.500 + Rs.60 courier charges. Outside India - US $ 30 including delivery charge.

Payment Options:

1. By Demand Draft / Payable at par cheque in favour of “SASHI PUBLICATIONS PRIVATE LIMITED”.

2. Direct ECS/deposit cash in our bank account number 402120110000327 of “SASHI PUBLICATIONS PRIVATE LIMITED”, Bank of India,

VVK Road Branch, Kolkata, India, IFSC Code: BKID0004021 and send us copy of Pay in slip by email at insurance.kolkata@gmail.com.

3. Deposit cheque in our bank account in your city and send us copy of Pay in slip by email.

4. Make online payment at our website www.sashipublications.com.

5. Pay via Paytm : Sashi Publications, Mobile : 9903040775

For any query please contact

Sashi Publications, C/o The Insurance Times, 25/1, Baranashi Ghosh Street, Near Girish Park, Kolkata – 700007

Phone: 033-40078428 /429 / 22184184 / 22696035, Portal: www.bimabazaar.com, Website: www.sashipublications.com

18 October 2017 Life Insurance Today

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010