Page 46 - Insurance Times December 2018

P. 46

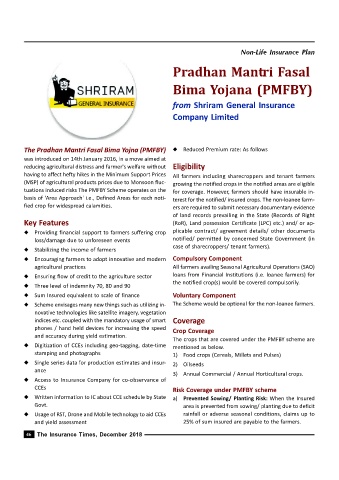

Non-Life Insurance Plan

Pradhan Mantri Fasal

Bima Yojana (PMFBY)

from Shriram General Insurance

Company Limited

The Pradhan Mantri Fasal Bima Yojna (PMFBY) u Reduced Premium rate: As follows

was introduced on 14th January 2016, in a move aimed at

reducing agricultural distress and farmer's welfare without Eligibility

having to affect hefty hikes in the Minimum Support Prices All farmers including sharecroppers and tenant farmers

(MSP) of agricultural products prices due to Monsoon fluc- growing the notified crops in the notified areas are eligible

tuations induced risks The PMFBY Scheme operates on the for coverage. However, farmers should have insurable in-

basis of 'Area Approach' i.e., Defined Areas for each noti- terest for the notified/ insured crops. The non-loanee farm-

fied crop for widespread calamities. ers are required to submit necessary documentary evidence

of land records prevailing in the State (Records of Right

Key Features (RoR), Land possession Certificate (LPC) etc.) and/ or ap-

u Providing financial support to farmers suffering crop plicable contract/ agreement details/ other documents

loss/damage due to unforeseen events notified/ permitted by concerned State Government (in

case of sharecroppers/ tenant farmers).

u Stabilizing the income of farmers

u Encouraging farmers to adopt innovative and modern Compulsory Component

agricultural practices All farmers availing Seasonal Agricultural Operations (SAO)

u Ensuring flow of credit to the agriculture sector loans from Financial Institutions (i.e. loanee farmers) for

the notified crop(s) would be covered compulsorily.

u Three level of indemnity 70, 80 and 90

u Sum Insured equivalent to scale of finance Voluntary Component

u Scheme envisages many new things such as utilizing in- The Scheme would be optional for the non-loanee farmers.

novative technologies like satellite imagery, vegetation

indices etc. coupled with the mandatory usage of smart Coverage

phones / hand held devices for increasing the speed

Crop Coverage

and accuracy during yield estimation.

The crops that are covered under the PMFBY scheme are

u Digitization of CCEs including geo-tagging, date-time mentioned as below.

stamping and photographs 1) Food crops (Cereals, Millets and Pulses)

u Single series data for production estimates and insur- 2) Oilseeds

ance

3) Annual Commercial / Annual Horticultural crops.

u Access to Insurance Company for co-observance of

CCEs

Risk Coverage under PMFBY scheme

u Written information to IC about CCE schedule by State a) Prevented Sowing/ Planting Risk: When the Insured

Govt. area is prevented from sowing/ planting due to deficit

u Usage of RST, Drone and Mobile technology to aid CCEs rainfall or adverse seasonal conditions, claims up to

and yield assessment 25% of sum insured are payable to the farmers.

46 The Insurance Times, December 2018