Page 47 - Insurance Times December 2018

P. 47

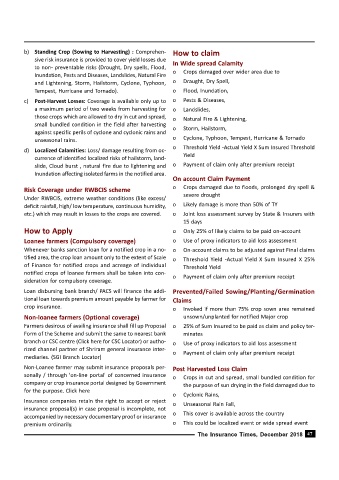

b) Standing Crop (Sowing to Harvesting) : Comprehen- How to claim

sive risk insurance is provided to cover yield losses due

In Wide spread Calamity

to non- preventable risks (Drought, Dry spells, Flood,

o Crops damaged over wider area due to

Inundation, Pests and Diseases, Landslides, Natural Fire

and Lightening, Storm, Hailstorm, Cyclone, Typhoon, o Draught, Dry Spell,

Tempest, Hurricane and Tornado). o Flood, Inundation,

c) Post-Harvest Losses: Coverage is available only up to o Pests & Diseases,

a maximum period of two weeks from harvesting for o Landslides,

those crops which are allowed to dry in cut and spread, o Natural Fire & Lightening,

small bundled condition in the field after harvesting

o Storm, Hailstorm,

against specific perils of cyclone and cyclonic rains and

unseasonal rains. o Cyclone, Typhoon, Tempest, Hurricane & Tornado

o Threshold Yield -Actual Yield X Sum Insured Threshold

d) Localized Calamities: Loss/ damage resulting from oc-

Yield

currence of identified localized risks of hailstorm, land-

slide, Cloud burst , natural fire due to lightening and o Payment of claim only after premium receipt

Inundation affecting isolated farms in the notified area.

On account Claim Payment

Risk Coverage under RWBCIS scheme o Crops damaged due to floods, prolonged dry spell &

severe drought

Under RWBCIS, extreme weather conditions (like excess/

deficit rainfall, high/ low temperature, continuous humidity, o Likely damage is more than 50% of TY

etc.) which may result in losses to the crops are covered. o Joint loss assessment survey by State & Insurers with

15 days

How to Apply o Only 25% of likely claims to be paid on-account

Loanee farmers (Compulsory coverage) o Use of proxy indicators to aid loss assessment

Whenever banks sanction loan for a notified crop in a no- o On-account claims to be adjusted against Final claims

tified area, the crop loan amount only to the extent of Scale o Threshold Yield -Actual Yield X Sum Insured X 25%

of Finance for notified crops and acreage of individual Threshold Yield

notified crops of loanee farmers shall be taken into con-

o Payment of claim only after premium receipt

sideration for compulsory coverage.

Loan disbursing bank branch/ PACS will finance the addi- Prevented/Failed Sowing/Planting/Germination

tional loan towards premium amount payable by farmer for Claims

crop insurance. o Invoked if more than 75% crop sown area remained

Non-loanee farmers (Optional coverage) unsown/unplanted for notified Major crop

Farmers desirous of availing insurance shall fill up Proposal o 25% of Sum Insured to be paid as claim and policy ter-

Form of the Scheme and submit the same to nearest bank minates

branch or CSC centre (Click here for CSC Locator) or autho- o Use of proxy indicators to aid loss assessment

rized channel partner of Shriram general insurance inter-

o Payment of claim only after premium receipt

mediaries. (SGI Branch Locator)

Non-Loanee farmer may submit insurance proposals per- Post Harvested Loss Claim

sonally / through 'on-line portal' of concerned insurance o Crops in cut and spread, small bundled condition for

company or crop insurance portal designed by Government the purpose of sun drying in the field damaged due to

for the purpose. Click here

o Cyclonic Rains,

Insurance companies retain the right to accept or reject

o Unseasonal Rain Fall,

insurance proposal(s) in case proposal is incomplete, not

o This cover is available across the country

accompanied by necessary documentary proof or insurance

premium ordinarily. o This could be localized event or wide spread event

The Insurance Times, December 2018 47