Page 42 - Life Insurance Today July - December 2020

P. 42

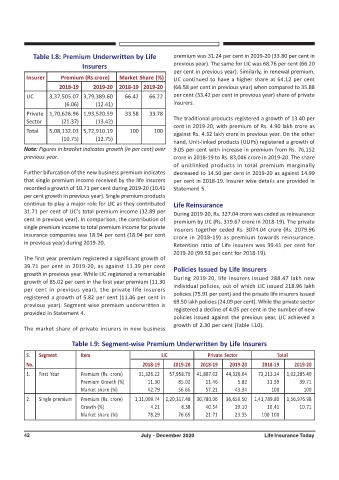

Table I.8: Premium Underwritten by Life premium was 31.24 per cent in 2019-20 (33.80 per cent in

Insurers previous year). The same for LIC was 68.76 per cent (66.20

per cent in previous year). Similarly, in renewal premium,

Insurer Premium (Rs.crore) Market Share (%) LIC continued to have a higher share at 64.12 per cent

2018-19 2019-20 2018-19 2019-20 (66.58 per cent in previous year) when compared to 35.88

LIC 3,37,505.07 3,79,389.60 66.42 66.22 per cent (33.42 per cent in previous year) share of private

(6.06) (12.41) insurers.

Private 1,70,626.96 1,93,520.59 33.58 33.78

The traditional products registered a growth of 13.40 per

Sector (21.37) (13.42)

cent in 2019-20, with premium of Rs. 4.90 lakh crore as

Total 5,08,132.03 5,72,910.19 100 100

against Rs. 4.32 lakh crore in previous year. On the other

(10.75) (12.75)

hand, Unit-linked products (ULIPs) registered a growth of

Note: Figures in bracket indicates growth (in per cent) over 9.05 per cent with increase in premium from Rs. 76,152

previous year. crore in 2018-19 to Rs. 83,046 crore in 2019-20. The share

of unitlinked products in total premium marginally

Further bifurcation of the new business premium indicates decreased to 14.50 per cent in 2019-20 as against 14.99

that single premium income received by the life insurers per cent in 2018-19. Insurer wise details are provided in

recorded a growth of 10.71 per cent during 2019-20 (10.41 Statement 5.

per cent growth in previous year). Single premium products

continue to play a major role for LIC as they contributed Life Reinsurance

31.71 per cent of LIC’s total premium income (32.89 per

During 2019-20, Rs. 327.04 crore was ceded as reinsurance

cent in previous year). In comparison, the contribution of premium by LIC (Rs. 319.67 crore in 2018-19). The private

single premium income to total premium income for private insurers together ceded Rs. 3074.04 crore (Rs. 2079.96

insurance companies was 18.94 per cent (18.04 per cent

crore in 2018-19) as premium towards reinsurance.

in previous year) during 2019-20. Retention ratio of Life insurers was 99.41 per cent for

2019-20 (99.53 per cent for 2018-19).

The first year premium registered a significant growth of

39.71 per cent in 2019-20, as against 11.39 per cent Policies Issued by Life Insurers

growth in previous year. While LIC registered a remarkable

During 2019-20, life insurers issued 288.47 lakh new

growth of 85.02 per cent in the first year premium (11.30

per cent in previous year), the private life insurers individual policies, out of which LIC issued 218.96 lakh

policies (75.91 per cent) and the private life insurers issued

registered a growth of 5.82 per cent (11.46 per cent in

69.50 lakh policies (24.09 per cent). While the private sector

previous year). Segment wise premium underwritten is

registered a decline of 4.05 per cent in the number of new

provided in Statement 4.

policies issued against the previous year, LIC achieved a

growth of 2.30 per cent (Table I.10).

The market share of private insurers in new business

Table I.9: Segment-wise Premium Underwritten by Life Insurers

S. Segment Item LIC Private Sector Total

No. 2018-19 2019-20 2018-19 2019-20 2018-19 2019-20

1. First Year Premium (Rs. crore) 31,326.22 57,958.76 41,887.02 44,326.64 73,213.24 1,02,285.40

Premium Growth (%) 11.30 85.02 11.46 5.82 11.39 39.71

Market share (%) 42.79 56.66 57.21 43.34 100 100

2. Single premium Premium (Rs. crore) 1,11,009.74 1,20,317.48 30,780.06 36,659.50 1,41,789.80 1,56,976.98

Growth (%) 4.21 8.38 40.54 19.10 10.41 10.71

Market share (%) 78.29 76.65 21.71 23.35 100 100

42 July - December 2020 Life Insurance Today