Page 44 - Life Insurance Today July - December 2020

P. 44

Table I.10: notified on May 09, 2016. These Regulations prescribe the

New Individual Policies issued by Life Insurers allowable limits of expenses of management taking into

account, inter alia the type and nature of product,

(in lakh)

premium paying term and duration of insurance business.

Insurer 2018-19 2019-20

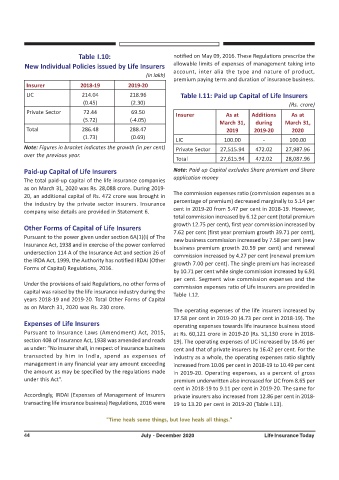

LIC 214.04 218.96 Table I.11: Paid up Capital of Life Insurers

(0.45) (2.30) (Rs. crore)

Private Sector 72.44 69.50

Insurer As at Additions As at

(5.72) (-4.05)

March 31, during March 31,

Total 286.48 288.47 2019 2019-20 2020

(1.73) (0.69)

LIC 100.00 - 100.00

Note: Figures in bracket indicates the growth (in per cent) Private Sector 27,515.94 472.02 27,987.96

over the previous year.

Total 27,615.94 472.02 28,087.96

Paid-up Capital of Life Insurers Note: Paid up Capital excludes Share premium and Share

application money

The total paid-up capital of the life insurance companies

as on March 31, 2020 was Rs. 28,088 crore. During 2019-

20, an additional capital of Rs. 472 crore was brought in The commission expenses ratio (commission expenses as a

percentage of premium) decreased marginally to 5.14 per

the industry by the private sector insurers. Insurance

cent in 2019-20 from 5.47 per cent in 2018-19. However,

company wise details are provided in Statement 6.

total commission increased by 6.12 per cent (total premium

growth 12.75 per cent), first year commission increased by

Other Forms of Capital of Life Insurers

7.62 per cent (first year premium growth 39.71 per cent),

Pursuant to the power given under section 6A(1)(i) of The

new business commission increased by 7.58 per cent (new

Insurance Act, 1938 and in exercise of the power conferred business premium growth 20.59 per cent) and renewal

undersection 114 A of the Insurance Act and section 26 of

commission increased by 4.27 per cent (renewal premium

the IRDA Act, 1999, the Authority has notified IRDAI (Other

growth 7.00 per cent). The single premium has increased

Forms of Capital) Regulations, 2016.

by 10.71 per cent while single commission increased by 6.91

per cent. Segment wise commission expenses and the

Under the provisions of said Regulations, no other forms of

commission expenses ratio of Life insurers are provided in

capital was raised by the life insurance industry during the

Table I.12.

years 2018-19 and 2019-20. Total Other Forms of Capital

as on March 31, 2020 was Rs. 230 crore.

The operating expenses of the life insurers increased by

17.58 per cent in 2019-20 (4.73 per cent in 2018-19). The

Expenses of Life Insurers operating expenses towards life insurance business stood

Pursuant to Insurance Laws (Amendment) Act, 2015, at Rs. 60,121 crore in 2019-20 (Rs. 51,130 crore in 2018-

section 40B of Insurance Act, 1938 was amended and reads 19). The operating expenses of LIC increased by 18.46 per

as under: “No insurer shall, in respect of insurance business cent and that of private insurers by 16.42 per cent. For the

transacted by him in India, spend as expenses of industry as a whole, the operating expenses ratio slightly

management in any financial year any amount exceeding increased from 10.06 per cent in 2018-19 to 10.49 per cent

the amount as may be specified by the regulations made in 2019-20. Operating expenses, as a percent of gross

under this Act”. premium underwritten also increased for LIC from 8.65 per

cent in 2018-19 to 9.11 per cent in 2019-20. The same for

Accordingly, IRDAI (Expenses of Management of Insurers private insurers also increased from 12.86 per cent in 2018-

transacting life insurance business) Regulations, 2016 were 19 to 13.20 per cent in 2019-20 (Table I.13).

"Time heals some things, but love heals all things."

44 July - December 2020 Life Insurance Today