Page 48 - Life Insurance Today July - December 2020

P. 48

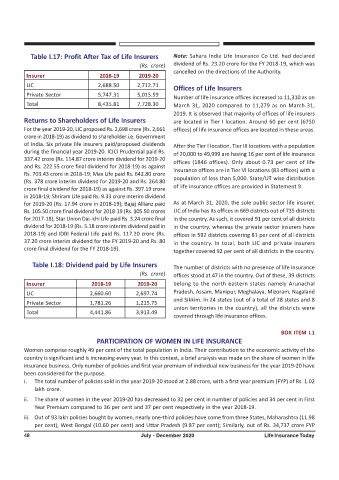

Table I.17: Profit After Tax of Life Insurers Note: Sahara India Life Insurance Co Ltd. had declared

(Rs. crore) dividend of Rs. 23.20 crore for the FY 2018-19, which was

cancelled on the directions of the Authority.

Insurer 2018-19 2019-20

LIC 2,688.50 2,712.71

Offices of Life Insurers

Private Sector 5,747.31 5,015.59

Number of life insurance offices increased to 11,310 as on

Total 8,435.81 7,728.30 March 31, 2020 compared to 11,279 as on March 31,

2019. It is observed that majority of offices of life insurers

Returns to Shareholders of Life Insurers are located in Tier I location. Around 60 per cent (6750

For the year 2019-20, LIC proposed Rs. 2,698 crore (Rs. 2,661 offices) of life insurance offices are located in these areas.

crore in 2018-19) as dividend to shareholder i.e. Government

of India. Six private life insurers paid/proposed dividends After the Tier I location, Tier III locations with a population

during the financial year 2019-20. ICICI Prudential paid Rs.

of 20,000 to 49,999 are having 16 per cent of life insurance

337.42 crore (Rs. 114.87 crore interim dividend for 2019-20 offices (1846 offices). Only about 0.73 per cent of life

and Rs. 222.55 crore final dividend for 2018-19) as against

Rs. 703.43 crore in 2018-19; Max Life paid Rs. 642.80 crore insurance offices are in Tier VI locations (83 offices) with a

population of less than 5,000. State/UT wise distribution

(Rs. 378 crore interim dividend for 2019-20 and Rs. 264.80

of life insurance offices are provided in Statement 9.

crore final dividend for 2018-19) as against Rs. 397.19 crore

in 2018-19; Shriram Life paid Rs. 9.33 crore interim dividend

for 2019-20 (Rs. 17.94 crore in 2018-19); Bajaj Allianz paid As at March 31, 2020, the sole public sector life insurer,

Rs. 105.50 crore final dividend for 2018-19 (Rs. 105.50 crores LIC of India has its offices in 669 districts out of 735 districts

for 2017-18); Star Union Dai-ichi Life paid Rs. 3.24 crore final in the country. As such, it covered 91 per cent of all districts

dividend for 2018-19 (Rs. 5.18 crore interim dividend paid in in the country, whereas the private sector insurers have

2018-19) and IDBI Federal Life paid Rs. 117.20 crore (Rs. offices in 592 districts covering 81 per cent of all districts

37.20 crore interim dividend for the FY 2019-20 and Rs. 80 in the country. In total, both LIC and private insurers

crore final dividend for the FY 2018-19).

together covered 92 per cent of all districts in the country.

Table I.18: Dividend paid by Life Insurers The number of districts with no presence of life insurance

(Rs. crore) offices stood at 47 in the country. Out of these, 39 districts

Insurer 2018-19 2019-20 belong to the north eastern states namely Arunachal

LIC 2,660.60 2,697.74 Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland

and Sikkim. In 24 states (out of a total of 28 states and 8

Private Sector 1,781.26 1,215.75

union territories in the country), all the districts were

Total 4,441.86 3,913.49

covered through life insurance offices.

BOX ITEM I.1

PARTICIPATION OF WOMEN IN LIFE INSURANCE

Women comprise roughly 49 per cent of the total population in India. Their contribution to the economic activity of the

country is significant and is increasing every year. In this context, a brief analysis was made on the share of women in life

insurance business. Only number of policies and first year premium of individual new business for the year 2019-20 have

been considered for the purpose.

i. The total number of policies sold in the year 2019-20 stood at 2.88 crore, with a first year premium (FYP) of Rs. 1.02

lakh crore.

ii. The share of women in the year 2019-20 has decreased to 32 per cent in number of policies and 34 per cent in First

Year Premium compared to 36 per cent and 37 per cent respectively in the year 2018-19.

iii. Out of 93 lakh policies bought by women, nearly one-third policies have come from three States, Maharashtra (11.98

per cent), West Bengal (10.60 per cent) and Uttar Pradesh (9.87 per cent); Similarly, out of Rs. 34,737 crore FYP

48 July - December 2020 Life Insurance Today