Page 45 - Life Insurance Today July - December 2020

P. 45

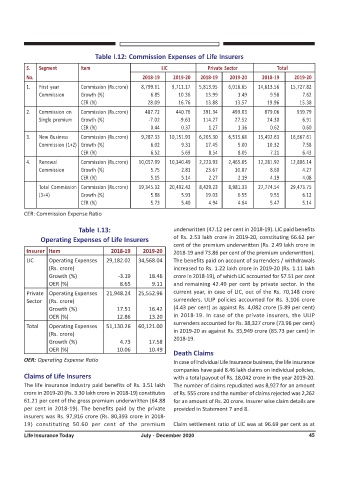

Table I.12: Commission Expenses of Life Insurers

S. Segment Item LIC Private Sector Total

No. 2018-19 2019-20 2018-19 2019-20 2018-19 2019-20

1. First year Commission (Rs.crore) 8,799.61 9,711.17 5,813.95 6,016.65 14,613.56 15,727.82

Commission Growth (%) 6.85 10.36 13.99 3.49 9.58 7.62

CER (%) 28.09 16.76 13.88 13.57 19.96 15.38

2. Commission on Commission (Rs.crore) 487.72 440.76 391.34 499.03 879.06 939.79

Single premium Growth (%) -7.02 -9.63 114.27 27.52 24.30 6.91

CER (%) 0.44 0.37 1.27 1.36 0.62 0.60

3. New Business Commission (Rs.crore) 9,287.33 10,151.93 6,205.30 6,515.68 15,492.63 16,667.61

Commission (1+2) Growth (%) 6.02 9.31 17.45 5.00 10.32 7.58

CER (%) 6.52 5.69 8.54 8.05 7.21 6.43

4. Renewal Commission (Rs.crore) 10,057.99 10,340.49 2,223.93 2,465.65 12,281.92 12,806.14

Commission Growth (%) 5.75 2.81 23.67 10.87 8.60 4.27

CER (%) 5.15 5.14 2.27 2.19 4.19 4.08

Total Commission Commission (Rs.crore) 19,345.32 20,492.42 8,429.23 8,981.33 27,774.54 29,473.75

(3+4) Growth (%) 5.88 5.93 19.03 6.55 9.55 6.12

CER (%) 5.73 5.40 4.94 4.64 5.47 5.14

CER: Commission Expense Ratio

Table I.13: underwritten (47.12 per cent in 2018-19). LIC paid benefits

Operating Expenses of Life Insurers of Rs. 2.53 lakh crore in 2019-20, constituting 66.62 per

cent of the premium underwritten (Rs. 2.49 lakh crore in

Insurer Item 2018-19 2019-20 2018-19 and 73.86 per cent of the premium underwritten).

LIC Operating Expenses 29,182.02 34,568.04 The benefits paid on account of surrenders / withdrawals

(Rs. crore) increased to Rs. 1.22 lakh crore in 2019-20 (Rs. 1.11 lakh

Growth (%) -3.19 18.46 crore in 2018-19), of which LIC accounted for 57.51 per cent

OER (%) 8.65 9.11 and remaining 42.49 per cent by private sector. In the

Private Operating Expenses 21,948.24 25,552.96 current year, in case of LIC, out of the Rs. 70,148 crore

Sector (Rs. crore) surrenders, ULIP policies accounted for Rs. 3,106 crore

Growth (%) 17.51 16.42 (4.43 per cent) as against Rs. 4,082 crore (5.89 per cent)

OER (%) 12.86 13.20 in 2018-19. In case of the private insurers, the ULIP

surrenders accounted for Rs. 38,327 crore (73.96 per cent)

Total Operating Expenses 51,130.26 60,121.00

in 2019-20 as against Rs. 35,949 crore (85.73 per cent) in

(Rs. crore)

2018-19.

Growth (%) 4.73 17.58

OER (%) 10.06 10.49

Death Claims

OER: Operating Expense Ratio In case of Individual Life Insurance business, the life insurance

companies have paid 8.46 lakh claims on individual policies,

Claims of Life Insurers with a total payout of Rs. 18,042 crore in the year 2019-20.

The life insurance industry paid benefits of Rs. 3.51 lakh The number of claims repudiated was 8,927 for an amount

crore in 2019-20 (Rs. 3.30 lakh crore in 2018-19) constitutes of Rs. 555 crore and the number of claims rejected was 2,262

61.21 per cent of the gross premium underwritten (64.88 for an amount of Rs. 20 crore. Insurer wise claim details are

per cent in 2018-19). The benefits paid by the private provided in Statement 7 and 8.

insurers was Rs. 97,916 crore (Rs. 80,393 crore in 2018-

19) constituting 50.60 per cent of the premium Claim settlement ratio of LIC was at 96.69 per cent as at

Life Insurance Today July - December 2020 45