Page 45 - Banking Finance March 2019

P. 45

ARTICLE

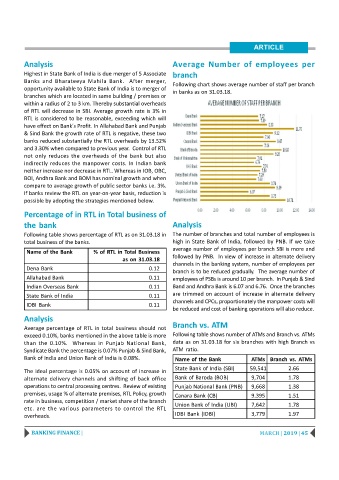

Analysis Average Number of employees per

Highest in State Bank of India is due merger of 5 Associate branch

Banks and Bharateeya Mahila Bank. After merger,

Following chart shows average number of staff per branch

opportunity available to State Bank of India is to merger of in banks as on 31.03.18.

branches which are located in same building / premises or

within a radius of 2 to 3 km. Thereby substantial overheads

of RTL will decrease in SBI. Average growth rate is 3% in

RTL is considered to be reasonable, exceeding which will

have effect on Bank's Profit. In Allahabad Bank and Punjab

& Sind Bank the growth rate of RTL is negative, these two

banks reduced substantially the RTL overheads by 13.52%

and 3.30% when compared to previous year. Control of RTL

not only reduces the overheads of the bank but also

indirectly reduces the manpower costs. In Indian bank

neither increase nor decrease in RTL. Whereas in IOB, OBC,

BOI, Andhra Bank and BOM has nominal growth and when

compare to average growth of public sector banks i.e. 3%.

If banks review the RTL on year-on-year basis, reduction is

possible by adopting the strategies mentioned below.

Percentage of in RTL in Total business of

the bank Analysis

Following table shows percentage of RTL as on 31.03.18 in The number of branches and total number of employees is

total business of the banks. high in State Bank of India, followed by PNB. If we take

average number of employees per branch SBI is more and

Name of the Bank % of RTL in Total Business

as on 31.03.18 followed by PNB. In view of increase in alternate delivery

channels in the banking system, number of employees per

Dena Bank 0.12

branch is to be reduced gradually. The average number of

Allahabad Bank 0.11 employees of PSBs is around 10 per branch. In Punjab & Sind

Indian Overseas Bank 0.11 Band and Andhra Bank is 6.07 and 6.76. Once the branches

State Bank of India 0.11 are trimmed on account of increase in alternate delivery

channels and CPCs, proportionately the manpower costs will

IDBI Bank 0.11

be reduced and cost of banking operations will also reduce.

Analysis

Average percentage of RTL in total business should not Branch vs. ATM

exceed 0.10%, banks mentioned in the above table is more Following table shows number of ATMs and Branch vs. ATMs

than the 0.10%. Whereas in Punjab National Bank, data as on 31.03.18 for six branches with high Branch vs

Syndicate Bank the percentage is 0.07% Punjab & Sind Bank, ATM ratio.

Bank of India and Union Bank of India is 0.08%. Name of the Bank ATMs Branch vs. ATMs

State Bank of India (SBI) 59,541 2.66

The ideal percentage is 0.05% on account of increase in

alternate delivery channels and shifting of back office Bank of Baroda (BOB) 9,704 1.78

operations to central processing centres. Review of existing Punjab National Bank (PNB) 9,668 1.38

premises, usage % of alternate premises, RTL Policy, growth Canara Bank (CB) 9.395 1.51

rate in business, competition / market share of the branch

Union Bank of India (UBI) 7,642 1.78

etc. are the various parameters to control the RTL

overheads. IDBI Bank (IDBI) 3,779 1.97

BANKING FINANCE | MARCH | 2019 | 45