Page 39 - Banking Finance October 2024

P. 39

ARTICLE

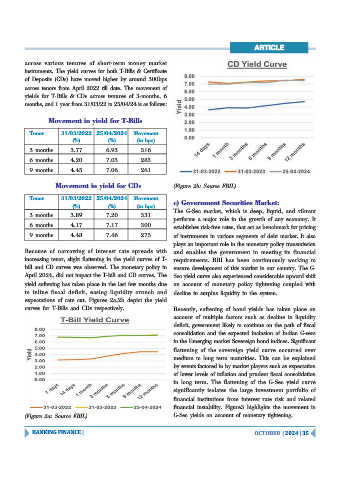

across various tenures of short-term money market

instruments. The yield curves for both T-Bills & Certificate

of Deposits (CDs) have moved higher by around 300bps

across tenors from April 2022 till date. The movement of

yields for T-Bills & CDs across tenures of 3-months, 6

months, and 1 year from 31/03/22 to 25/04/24 is as follows:

Movement in yield for T-Bills

Tenor 31/03/2022 25/04/2024 Movement

(%) (%) (in bps)

3 months 3.77 6.93 316

6 months 4.20 7.03 283

9 months 4.45 7.06 261

Movement in yield for CDs (Figure 2b: Source FBIL)

Tenor 31/03/2022 25/04/2024 Movement

c) Government Securities Market:

(%) (%) (in bps)

The G-Sec market, which is deep, liquid, and vibrant

3 months 3.89 7.20 331

performs a major role in the growth of any economy. It

6 months 4.17 7.17 300

establishes risk-free rates, that act as benchmark for pricing

9 months 4.48 7.46 275 of instruments in various segments of debt market. It also

plays an important role in the monetary policy transmission

Because of narrowing of interest rate spreads with and enables the government in meeting its financial

increasing tenor, slight flattening in the yield curves of T- requirements. RBI has been continuously working to

bill and CD curves was observed. The monetary policy in ensure development of this market in our country. The G-

April 2024, did not impact the T-bill and CD curves. The Sec yield curve also experienced considerable upward shift

yield softening has taken place in the last few months due on account of monetary policy tightening coupled with

to inline fiscal deficit, easing liquidity crunch and decline in surplus liquidity in the system.

expectations of rate cut. Figures 2a,2b depict the yield

curves for T-Bills and CDs respectively. Recently, softening of bond yields has taken place on

account of multiple factors such as decline in liquidity

deficit, government likely to continue on the path of fiscal

consolidation and the expected inclusion of Indian G-secs

in the Emerging market Sovereign bond indices. Significant

flattening of the sovereign yield curve occurred over

medium to long term maturities. This can be explained

by events factored in by market players such as expectation

of lower levels of inflation and prudent fiscal consolidation

in long term. The flattening of the G-Sec yield curve

significantly isolates the large investment portfolio of

financial institutions from interest rate risk and related

financial instability. Figure3 highlights the movement in

(Figure 2a: Source FBIL) G-Sec yields on account of monetary tightening.

BANKING FINANCE | OCTOBER | 2024 | 35