Page 17 - CFCM Mar-Apr 2021_Neat

P. 17

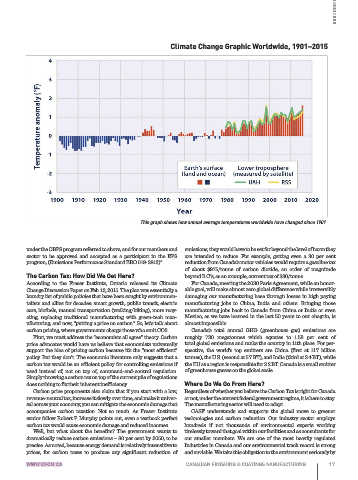

Climate Change Graphic Worldwide, 1901–2015

This graph shows how annual average temperatures worldwide have changed since 1901.

under the OBPS program referred to above, and for our members and emissions, they would have to be set far beyond the level of harm they

sector to be approved and accepted as a participant in the EPS are intended to reduce. For example, getting even a 30 per cent

program, (Emissions Performance Standard ERO 019-2813)”. reduction from Canada’s motor vehicles would require a gasoline tax

of about $975/tonne of carbon dioxide, an order of magnitude

The Carbon Tax: How Did We Get Here? beyond B.C.’s, as an example, current tax of $30/tonne.

According to the Fraser Institute, Ontario released its Climate For Canada, meeting the 2030 Paris Agreement, while an honor-

Change Discussion Paper on Feb. 12, 2015. The plan was essentially a able goal, will make almost zero global difference while irreversibly

laundry list of public policies that have been sought by environmen- damaging our manufacturing base through losses in high paying

talists and allies for decades: smart growth, public transit, electric manufacturing jobs to China, India and others. Bringing those

cars, biofuels, manual transportation (walking/biking), more recy- manufacturing jobs back to Canada from China or India or even

cling, replacing traditional manufacturing with green-tech man- Mexico, as we have learned in the last 50 years to our chagrin, is

ufacturing, and now, “putting a price on carbon.” So, let’s talk about almost impossible.

carbon pricing, where governments charge those who emit CO2. Canada’s total annual GHG (greenhouse gas) emissions are

First, we must address the “economists all agree” theory. Carbon roughly 730 megatonnes which equates to 1.58 per cent of

price advocates would have us believe that economists universally total global emissions and ranks the country in 11th place. For per-

support the idea of pricing carbon because it’s the “most efficient” spective, the world’s top emitters are China (first at 11.7 billion

policy. But they don’t. The economic literature only suggests that a tonnes), the U.S. (second at 5.7 BT), and India (third at 3.4 BT), while

carbon tax would be an efficient policy for controlling emissions if the EU as a region is responsible for 3.2 BT. Canada is a small emitter

used instead of, not on top of, command-and-control regulation. of greenhouse gasses on the global scale.

Simply throwing a carbon tax on top of the current pile of regulations

does nothing to fix their inherent inefficiency. Where Do We Go From Here?

Carbon price proponents also claim that if you start with a low, Regardless of whether you believe the Carbon Tax is right for Canada

revenue-neutral tax, increase it slowly over time, and make it univer- or not, under the current federal government regime, it is here to stay.

sal across your economy, you can mitigate the economic damage that The manufacturing sector will need to adapt.

accompanies carbon taxation. Not so much. As Fraser Institute CASF understands and supports the global move to greener

senior fellow Robert P. Murphy points out, even a textbook perfect technologies and carbon reduction. Our industry sector employs

carbon tax would cause economic damage and reduced incomes. hundreds if not thousands of environmental experts working

Well, but what about the benefits? The government wants to tirelessly toward that goal within our facilities and as consultants for

dramatically reduce carbon emissions – 80 per cent by 2050, to be our smaller members. We are one of the most heavily regulated

precise. As noted, because energy demand is relatively insensitive to Industries in Canada and our environmental track record is strong

prices, for carbon taxes to produce any significant reduction of and enviable. We take this obligation to the environment seriously by

WWW.CFCM.CA CANADIAN FINISHING & COATINGS MANUFACTURING 17