Page 92 - All files for Planning Inspectorate update

P. 92

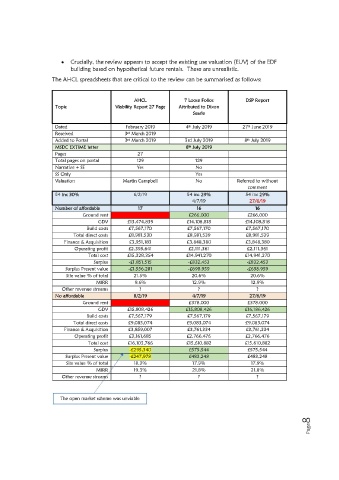

Crucially, the review appears to accept the existing use valuation (EUV) of the EDF

building based on hypothetical future rentals. These are unrealistic.

The AHCL spreadsheets that are critical to the review can be summarised as follows:

AHCL 7 Loose Folios DSP Report

Topic Viability Report 27 Page Attributed to Dixon

Searle

Dated February 2019 4 July 2019 27 June 2019

th

th

Received 3 March 2019

rd

Added to Portal 3 March 2019 3rd July 2019 8 July 2019

th

rd

MSDC EXTIME letter 8 July 2019

th

Pages 27

Total pages on portal 129 129

Narrative + SS Yes No

SS Only Yes

Valuation Martin Campbell No Referred to without

comment

54 inc 30% 6/2/19 54 inc 29% 54 inc 29%

4/7/19 27/6/19

Number of affordable 17 16 16

Ground rent 266,000 266,000

GDV 13,474,839 14,108,818 14,108,818

Build costs 7,567,170 7,567,170 7,567,170

Total direct costs 8,981,530 8,981,539 8,981,539

Finance & Acquisition 3,951,183 3,848,380 3,848,380

Operating profit 2,395,641 2,111,361 2,111,361

Total cost 15,328,354 14,941,270 14,941,270

Surplus - 1,851,515 - 832,453 - 832,453

Surplus Present value - 1,556,281 - 698,959 - 698,959

Site value % of tota 21.5% 20.6% 20.6%

l

MIRR 9.6% 12.9% 12.9%

Other revenue streams ? ? ?

No affordable 8/2/19 4/7/19 27/6/19

Ground rent 378,000 378,000

GDV 15,808,426 15,808,426 16,186,426

Build costs 7,567,179 7,567,179 7,567,179

Total direct costs 9,083,074 9,083,074 9,083,074

Finance & Acquisition 3,859,007 3,761,334 3,761,334

Operating profit 3,161,685 2,766.476 2,766,476

Total cost 16,103,766 15,610,882 15,610,882

Surplus - 295,340 575,544 575,544

Surplus Present value - 247,978 483,248 483,248

Site value % of total 18.3% 17.9% 17.9%

MIRR 19.3% 21.8% 21.8%

Other revenue streams ? ? ?

The open market scheme was unviable