Page 44 - S:\New Website Files\Annual Reports\

P. 44

Wisconsin Health and Educational Facilities Authority

Notes to Financial Statements

June 30, 2019 and 2018

NOTE 2 CASH AND CASH EQUIVALENTS AND INVESTMENT SECURITIES (continued)

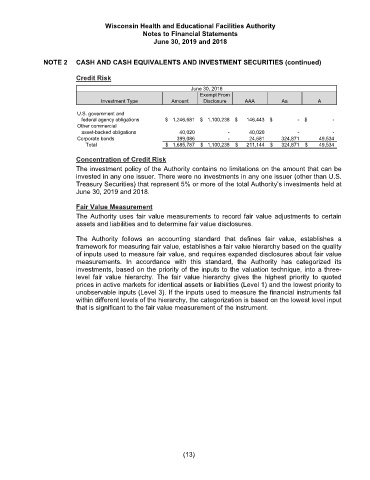

Credit Risk

June 30, 2018

Exempt From

Investment Type Amount Disclosure AAA Aa A

U.S. government and

federal agency obligations $ 1,246,681 $ 1,100,238 $ 146,443 $ - $ -

Other commercial

asset-backed obligations 40,020 - 40,020 - -

Corporate bonds 399,086 - 24,681 324,871 49,534

Total $ 1,685,787 $ 1,100,238 $ 211,144 $ 324,871 $ 49,534

Concentration of Credit Risk

The investment policy of the Authority contains no limitations on the amount that can be

invested in any one issuer. There were no investments in any one issuer (other than U.S.

Treasury Securities) that represent 5% or more of the total Authority’s investments held at

June 30, 2019 and 2018.

Fair Value Measurement

The Authority uses fair value measurements to record fair value adjustments to certain

assets and liabilities and to determine fair value disclosures.

The Authority follows an accounting standard that defines fair value, establishes a

framework for measuring fair value, establishes a fair value hierarchy based on the quality

of inputs used to measure fair value, and requires expanded disclosures about fair value

measurements. In accordance with this standard, the Authority has categorized its

investments, based on the priority of the inputs to the valuation technique, into a three-

level fair value hierarchy. The fair value hierarchy gives the highest priority to quoted

prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to

unobservable inputs (Level 3). If the inputs used to measure the financial instruments fall

within different levels of the hierarchy, the categorization is based on the lowest level input

that is significant to the fair value measurement of the instrument.

(13)