Page 145 - Business Principles and Management

P. 145

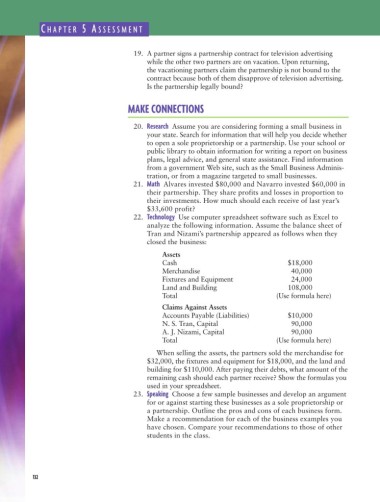

C HAPTER 5 A SSESSMENT

19. A partner signs a partnership contract for television advertising

while the other two partners are on vacation. Upon returning,

the vacationing partners claim the partnership is not bound to the

contract because both of them disapprove of television advertising.

Is the partnership legally bound?

MAKE CONNECTIONS

20. Research Assume you are considering forming a small business in

your state. Search for information that will help you decide whether

to open a sole proprietorship or a partnership. Use your school or

public library to obtain information for writing a report on business

plans, legal advice, and general state assistance. Find information

from a government Web site, such as the Small Business Adminis-

tration, or from a magazine targeted to small businesses.

21. Math Alvares invested $80,000 and Navarro invested $60,000 in

their partnership. They share profits and losses in proportion to

their investments. How much should each receive of last year’s

$33,600 profit?

22. Technology Use computer spreadsheet software such as Excel to

analyze the following information. Assume the balance sheet of

Tran and Nizami’s partnership appeared as follows when they

closed the business:

Assets

Cash $18,000

Merchandise 40,000

Fixtures and Equipment 24,000

Land and Building 108,000

Total (Use formula here)

Claims Against Assets

Accounts Payable (Liabilities) $10,000

N. S. Tran, Capital 90,000

A. J. Nizami, Capital 90,000

Total (Use formula here)

When selling the assets, the partners sold the merchandise for

$32,000, the fixtures and equipment for $18,000, and the land and

building for $110,000. After paying their debts, what amount of the

remaining cash should each partner receive? Show the formulas you

used in your spreadsheet.

23. Speaking Choose a few sample businesses and develop an argument

for or against starting these businesses as a sole proprietorship or

a partnership. Outline the pros and cons of each business form.

Make a recommendation for each of the business examples you

have chosen. Compare your recommendations to those of other

students in the class.

132