Page 604 - Business Principles and Management

P. 604

Chapter 22 • Pricing and Promotion

it is the price they pay their supplier to buy the product plus the cost of tran-

sporting it to their location for resale to their customers. For example, if the in- facts

voice price of an item is $55 and the transportation charge is $5, the cost of &

goods sold is $60.

Operating expenses are the costs of operating a business. They do not include figures

costs involved in the actual production or purchase of merchandise, which would

be part of the cost of goods sold. Most costs involved in the day-to-day running

of a business fall into this category. Figure 22-3 (see p. 592) lists some common Around 80 percent of car buy-

operating expenses. ers use Internet services that

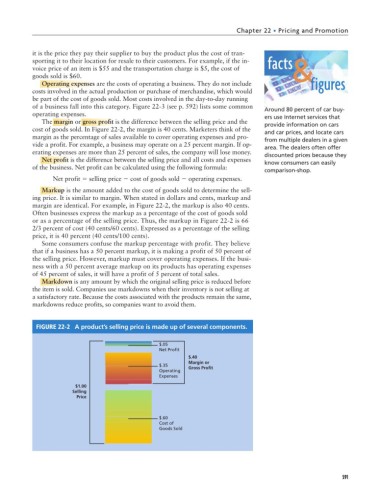

The margin or gross profit is the difference between the selling price and the

cost of goods sold. In Figure 22-2, the margin is 40 cents. Marketers think of the provide information on cars

and car prices, and locate cars

margin as the percentage of sales available to cover operating expenses and pro- from multiple dealers in a given

vide a profit. For example, a business may operate on a 25 percent margin. If op- area. The dealers often offer

erating expenses are more than 25 percent of sales, the company will lose money. discounted prices because they

Net profit is the difference between the selling price and all costs and expenses

of the business. Net profit can be calculated using the following formula: know consumers can easily

comparison-shop.

Net profit selling price cost of goods sold operating expenses.

Markup is the amount added to the cost of goods sold to determine the sell-

ing price. It is similar to margin. When stated in dollars and cents, markup and

margin are identical. For example, in Figure 22-2, the markup is also 40 cents.

Often businesses express the markup as a percentage of the cost of goods sold

or as a percentage of the selling price. Thus, the markup in Figure 22-2 is 66

2/3 percent of cost (40 cents/60 cents). Expressed as a percentage of the selling

price, it is 40 percent (40 cents/100 cents).

Some consumers confuse the markup percentage with profit. They believe

that if a business has a 50 percent markup, it is making a profit of 50 percent of

the selling price. However, markup must cover operating expenses. If the busi-

ness with a 50 percent average markup on its products has operating expenses

of 45 percent of sales, it will have a profit of 5 percent of total sales.

Markdown is any amount by which the original selling price is reduced before

the item is sold. Companies use markdowns when their inventory is not selling at

a satisfactory rate. Because the costs associated with the products remain the same,

markdowns reduce profits, so companies want to avoid them.

FIGURE 22-2 A product’s selling price is made up of several components.

$.05

Net Profit

$.40

Margin or

$.35

Gross Profit

Operating

Expenses

$1.00

Selling

Price

$.60

Cost of

Goods Sold

591