Page 490 - Introduction to Business

P. 490

464 PART 5 Finance

market risk The risk of an individual Market risk relates to the tendency of an individual firm’s bond and stock prices

firm’s stock prices going down in value to be affected by movements in the entire financial market. The Standard & Poor’s

as bond market prices move down, and

vice versa 500 (S&P 500) index represents the average return on the 500 largest U.S. firms’

stocks. When this average market index goes up or down, it is generally true that

most U.S. firms’ stock prices likewise fall or rise. Otherwise known as systematic

risk, this risk cannot be avoided by the investor. Likewise, the bond market as a

interest rate risk The risk of bond

prices moving down as the general level whole can systematically go up and down as interest rates change over time. This

of interest rates moves up, and vice interest rate risk is another type of market risk that the investor cannot control.

versa

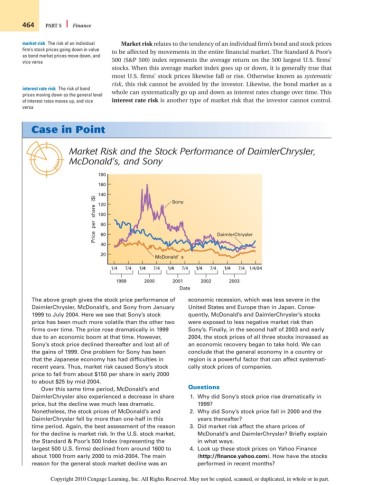

Case in Point

Market Risk and the Stock Performance of DaimlerChrysler,

McDonald’s, and Sony

180

160

Price per share ($) 140 Sony

120

100

80

60

40 DaimlerChrysler

20

McDonald’ s

1/4

1/4

1/4

1/4 7/4 1/4 7/4 1/4 7/4 1/4 7/4 1/4 7/4 1/4/04

1/4

1999 2000 2001 2002 2003

Date

The above graph gives the stock price performance of economic recession, which was less severe in the

DaimlerChrysler, McDonald’s, and Sony from January United States and Europe than in Japan. Conse-

1999 to July 2004. Here we see that Sony’s stock quently, McDonald’s and DaimlerChrysler’s stocks

price has been much more volatile than the other two were exposed to less negative market risk than

firms over time. The price rose dramatically in 1999 Sony’s. Finally, in the second half of 2003 and early

due to an economic boom at that time. However, 2004, the stock prices of all three stocks increased as

Sony’s stock price declined thereafter and lost all of an economic recovery began to take hold. We can

the gains of 1999. One problem for Sony has been conclude that the general economy in a country or

that the Japanese economy has had difficulties in region is a powerful factor that can affect systemati-

recent years. Thus, market risk caused Sony’s stock cally stock prices of companies.

price to fall from about $150 per share in early 2000

to about $25 by mid-2004.

Over this same time period, McDonald’s and Questions

DaimlerChrysler also experienced a decrease in share 1. Why did Sony’s stock price rise dramatically in

price, but the decline was much less dramatic. 1999?

Nonetheless, the stock prices of McDonald’s and 2. Why did Sony’s stock price fall in 2000 and the

DaimlerChrysler fell by more than one-half in this years thereafter?

time period. Again, the best assessment of the reason 3. Did market risk affect the share prices of

for the decline is market risk. In the U.S. stock market, McDonald’s and DaimlerChrysler? Briefly explain

the Standard & Poor’s 500 Index (representing the in what ways.

largest 500 U.S. firms) declined from around 1600 to 4. Look up these stock prices on Yahoo Finance

about 1000 from early 2000 to mid-2004. The main (http://finance.yahoo.com). How have the stocks

reason for the general stock market decline was an performed in recent months?

Copyright 2010 Cengage Learning, Inc. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part.