Page 11 - CCFA Journal - 11th Issue

P. 11

加中金融 宏观经济 Macro Economy

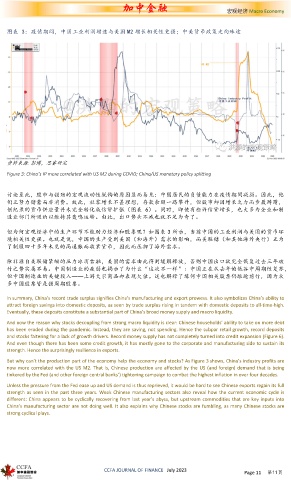

图表 3: 疫情期间,中国工业利润增速与美国 M2 增长相关性更强;中美货币政策走向殊途

资料来源 : 彭博,思睿研究

Figure 3: China’s IP more correlated with US M2 during COVID; China/US monetary policy splitting

讨论至此,股市与强劲的宏观流动性脱钩的原因显而易见:中国居民的负债能力在疫情期间减弱。因此,他

们正努力储蓄而非消费。故此,社零增长不甚理想,存款余额一路攀升,但股市却因增长乏力而步履踌躇,

创纪录的货币供应量并未完全转化成信贷扩张(图表 6)。同时,即使有些许信贷增长,也大多为企业和制

造业部门所吸纳以维持其轰鸣运转。由此,出口势头不减也就不足为奇了。

但为何宏观经济中的生产环节不能助力经济和股票呢?如图表 3 所示,当前中国的工业利润与美国的货币环

境相关性更强。也就是说,中国的生产受到美国(和海外)需求的影响,而美联储(和其他海外央行)正为

了制服四十多年未见的高通胀而收紧货币,因此而压抑了海外需求。

除非源自美联储紧缩的压力冰消雪融,美国的需求由此得到缓解释放,否则中国出口欲完全恢复过去三年破

竹之势实属不易。中国制造业的疲弱也揭示了为什么“这次不一样”:中国正在从去年的低谷中周期性复苏,

但中国制造业的关键投入——上游大宗商品却表现欠佳。这也解释了缘何中国相关股票仍踉跄前行,因为众

多中国股票皆是强周期股票。

In summary, China’s record trade surplus signifies China’s manufacturing and export prowess. It also symbolizes China’s ability to

attract foreign savings into domestic deposits, as seen by trade surplus rising in tandem with domestic deposits to all-time-high.

Eventually, these deposits constitute a substantial part of China’s broad money supply and macro liquidity.

And now the reason why stocks decoupling from strong macro liquidity is clear: Chinese households’ ability to take on more debt

has been eroded during the pandemic. Instead, they are saving, not spending. Hence the subpar retail growth, record deposits

and stocks faltering for a lack of growth drivers. Record money supply has not completely turned into credit expansion (Figure 6).

And even though there has been some credit growth, it has mostly gone to the corporate and manufacturing side to sustain its

strength. Hence the surprisingly resilience in exports.

But why can’t the production part of the economy help the economy and stocks? As Figure 3 shows, China’s industry profits are

now more correlated with the US M2. That is, Chinese production are affected by the US (and foreign) demand that is being

tinkered by the Fed (and other foreign central banks’) tightening campaign to combat the highest inflation in over four decades.

Unless the pressure from the Fed ease up and US demand is thus reprieved, it would be hard to see Chinese exports regain its full

strength as seen in the past three years. Weak Chinese manufacturing sectors also reveal how the current economic cycle is

different: China appears to be cyclically recovering from last year’s abyss, but upstream commodities that are key inputs into

China’s manufacturing sector are not doing well. It also explains why Chinese stocks are fumbling, as many Chinese stocks are

strong cyclical plays.

CCFA JOURNAL OF FINANCE July 2023 Page 11 第11页