Page 9 - CCFA Journal - 11th Issue

P. 9

加中金融 宏观经济 Macro Economy

中国经济复苏为何步履蹒跚?

经过一季度良好的开局,经济数据于四月逐渐放缓。社零增长略逊预期,投资增速继续下降,然而货币政策历史性宽松—

—在约 120 万亿元的经济总量中,广义货币供应量(M2)增长超过 30 万亿元。刺激措施宛如虚空打靶,令不少人对于复

苏的持续性心生疑窦。

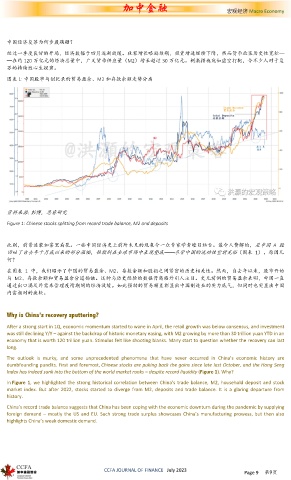

图表 1: 中国股市与创纪录的贸易盈余、M2 和存款余额走势分离

资料来源 : 彭博,思睿研究

Figure 1: Chinese stocks splitting from record trade balance, M2 and deposits

此刻,前景迷蒙如雾里看花。一些中国经济史上前所未见的现象令一众专家学者瞠目结舌。最令人费解的,是中国 A 股

回吐了自去年十月底以来的部分涨幅,恒指则在全球市场中表现垫底——尽管中国的流动性空前充裕(图表 1)。原因几

何?

在图表 1 中,我们昭示了中国的贸易盈余、M2、存款余额和股指之间紧密的历史相关性。然而,自去年以来,股市开始

与 M2、存款余额和贸易盈余分道扬镳。这种与历史经验的数据背离格外引人注目。史无前例的贸易盈余表明,中国一直

通过出口满足外需来管理疫情期间的经济放缓。如此强劲的贸易顺差彰显出中国制造业的实力底气,但同时也突显出中国

内需相对的疲软。

Why is China’s recovery sputtering?

After a strong start in 1Q, economic momentum started to wane in April, the retail growth was below consensus, and investment

was still declining Y/Y – against the backdrop of historic monetary easing, with M2 growing by more than 30 trillion yuan YTD in an

economy that is worth 120 trillion yuan. Stimulus felt like shooting blanks. Many start to question whether the recovery can last

long.

The outlook is murky, and some unprecedented phenomena that have never occurred in China’s economic history are

dumbfounding pundits. First and foremost, Chinese stocks are puking back the gains since late last October, and the Hang Seng

Index has indeed sunk into the bottom of the world market ranks – despite record liquidity (Figure 1). Why?

In Figure 1, we highlighted the strong historical correlation between China’s trade balance, M2, household deposit and stock

market index. But after 2022, stocks started to diverge from M2, deposits and trade balance. It is a glaring departure from

history.

China’s record trade balance suggests that China has been coping with the economic downturn during the pandemic by supplying

foreign demand – mostly the US and EU. Such strong trade surplus showcases China’s manufacturing prowess, but then also

highlights China’s weak domestic demand.

CCFA JOURNAL OF FINANCE July 2023 Page 9 第9页