Page 37 - CCFA Journal - Second Issue

P. 37

加中金融

利率风险举例: IR Risk Example:

Figure 2. IR Risk Example

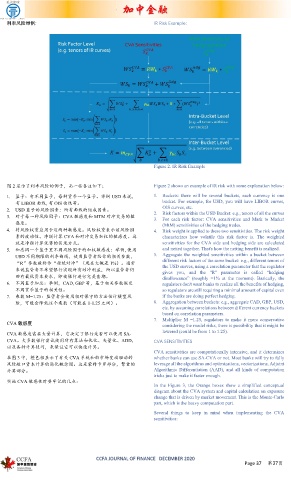

图 2 显示了利率风险的例子,而一些备注如下: Figure 2 shows an example of IR risk with some explanation below:

1. 篮子:有不同篮子,每种货币一个篮子。举例 USD 来说, 1. Buckets: there will be several buckets, each currency is one

有 LIBOR 曲线, 有 OIS 曲线等。 bucket. For example, for USD, you will have LIBOR curves,

OIS curves, etc.

2. USD 篮子的风险因素:所有曲线的组成因素。 2. Risk factors within the USD Bucket: e.g., tenors of all the curves

3. 对于每一种风险因子:CVA 敏感度和 MTM 对冲交易的敏 3. For each risk factor: CVA sensitivities and Mark to Market

感度。 (MtM) sensitivities of the hedging trades.

4. 将风险权重应用于这两种敏感度。风险权重表示该风险因 4. Risk weight is applied to these two sensitivities. The risk weight

素的波动性。净额计算 CVA 和对冲交易加权的敏感度。这 characterizes how volatile this risk factor is. The weighted

就是净额计算优势的实现方式。 sensitivities for the CVA side and hedging side are calculated

5. 加总同一个篮子里不同风险因子的加权敏感度:举例, 使用 and netted together. That's how the netting benefit is realized.

USD 不同期限的利率曲线,使用监管者给你的相关参数, 5. Aggregate the weighted sensitivities within a bucket between

different risk factors of the same bucket: e.g., different tenors of

“R”参数被称作“拒绝对冲”(现在大概是 1%)。通常 the USD curves, using a correlation parameter that the regulator

来说监管者不希望银行实现所有对冲利益,所以监管者仍 gives you, and the "R" parameter is called “hedging

旧有最低资本要求,即使银行进行完美套期。 disallowance” (roughly =1% at the moment). Basically, the

6. 不同篮子加总:举例,CAD, GBP 等,基于相关参数假定 regulators don't want banks to realize all the benefits of hedging,

不同货币篮子的相关性。 so regulators are still requiring a minimal amount of capital even

7. 乘数 M=1.25:监管者会使用相对保守的方法估计模型风 if the banks are doing perfect hedging.

险,可能会降低这个乘数(可能在 1-1.25 之间)。 6. Aggregation between buckets: e.g., aggregate CAD, GBP, USD,

etc. by assuming correlations between different currency buckets

based on correlation parameters.

7. Multiplier M =1.25, regulators to make it more conservative

CVA 敏感度

considering the model risks, there is possibility that it might be

lowered (could be from 1 to 1.25).

CVA 敏感度需要大量计算,它决定了银行是否可以使用 SA-

CVA。大多数银行尝试使用所有算法和优化、矢量化、ADD, CVA SENSITIVITIES

以及各种计算技巧,来保证它可以快速计算。

CVA sensitivities are computationally intensive, and it determines

在图 3 中,橙色框显示了有关 CVA 系统和由市场变动驱动的 whether banks can use SA-CVA or not. Most banks will try to fully

风险敞口资本计算的简化概念图。这是蒙特卡罗部分,繁重的 leverage all the algorithms and optimizations, vectorizations, Adjoint

计算部分。 Algorithmic Differentiation (AAD), and all kinds of computation

tricks just to make it faster enough.

实施 CVA 敏感性时要牢记的几点:

In the Figure 3, the Orange boxes show a simplified conceptual

diagram about the CVA system and capital calculation on exposure

change that is driven by market movement. This is the Monte-Carlo

part, which is the heavy computation part.

Several things to keep in mind when implementing the CVA

sensitivities:

CCFA JOURNAL OF FINANCE DECEMBER 2020

Page 37 第37页