Page 35 - CCFA Journal - Sixth Issue

P. 35

加中金融 Market 市场分析

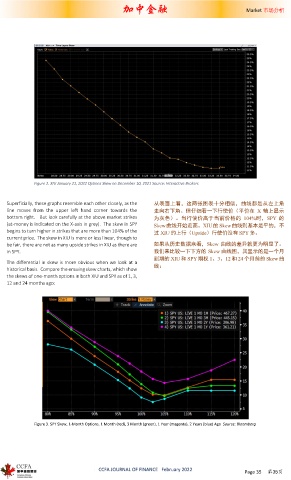

Figure 2. XIU January 21, 2022 Options Skew on December 10, 2021 Source: Interactive Brokers

Superficially, these graphs resemble each other closely, as the 从表面上看,这两张图表十分相似,曲线都是从左上角

line moves from the upper left hand corner towards the 走向右下角。但仔细看一下行使价(平价在 X 轴上显示

bottom right. But look carefully at the above market strikes 为灰色)。当行使价高于当前价格的 104%时,SPY 的

(at-money is indicated on the X-axis in grey). The skew in SPY Skew 曲线开始走高。XIU 的 Skew 曲线则基本是平的,不

begins to turn higher in strikes that are more than 104% of the 过 XIU 的上行(Upside)行使价没有 SPY 多。

current price. The skew in XIU is more or less linear, though to

be fair, there are not as many upside strikes in XIU as there are 如果从历史数据来看,Skew 曲线的差异就更为明显了。

in SPY. 我们来比较一下下方的 Skew 曲线图,其显示的是一个月

到期的 XIU 和 SPY 期权 1、3、12 和 24 个月前的 Skew 曲

The differential in skew is more obvious when we look at a

historical basis. Compare the ensuing skew charts, which show 线:

the skews of one-month options in both XIU and SPY as of 1, 3,

12 and 24 months ago:

Figure 3. SPY Skew, 1-Month Options, 1 Month (red), 3 Month (green), 1 Year (magenta), 2 Years (blue) Ago Source: Bloomberg

CCFA JOURNAL OF FINANCE February 2022

Page 35 第35页