Page 37 - CCFA Journal - Sixth Issue

P. 37

加中金融 Market 市场分析

Figure 5. XLF Skew, 1-Month Options, 1 Month (red), 3 Month (green), 1 Year (magenta), 2 Years (blue) Ago

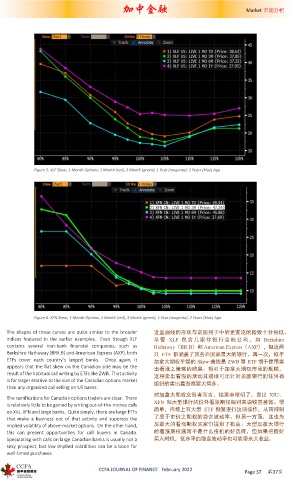

Figure 6. XFN Skew, 1-Month Options, 1 Month (red), 3 Month (green), 1 Year (magenta), 2 Years (blue) Ago

The shapes of these curves are quite similar to the broader 这些曲线的形状与前面列子中的更宽泛的指数十分相似。

indices featured in the earlier examples. Even though XLF 尽 管 XLF 包 含 几 家 非 银 行 金 融 公 司 , 如 Berkshire

contains several non-bank financial companies, such as Hathaway(BR.B)和 American Express(AXP),但这两

Berkshire Hathaway (BRK.B) and American Express (AXP), both 只 ETF 都涵盖了其各自国家最大的银行。再一次,似乎

ETFs cover each country’s largest banks. Once again, it 加拿大期权平缓的 Skew 曲线是 ZWB 等 ETF 惯于使用卖

appears that the flat skew on the Canadian side may be the 出看涨之策略的结果。相对于加拿大期权市场的规模,

result of the habitual call writing by ETFs like ZWB. That activity 这种卖出看涨的活动其规模可比针对美国银行的任何有

is far larger relative to the size of the Canadian options market 组织的卖出看涨都要大得多。

than any organized call selling on US banks.

对加拿大期权交易者而言,结果非常明了。卖出 XIU、

The ramifications for Canadian options traders are clear. There

is relatively little to be gained by writing out-of-the-money calls XFN 和大型银行的价外看涨期权相对来说收益甚微。很

on XIU, XFN and large banks. Quite simply, there are large ETFs 简单,市场上有大型 ETF 频繁进行这项操作,从而抑制

that make a business out of that activity and suppress the 了高于市价之期权的隐含波动率。但另一方面,这也为

implied volatility of above-market options. On the other hand, 加拿大的看涨期权买家们提供了机会。大型加拿大银行

this can present opportunities for call buyers in Canada. 的看涨期权通常不是什么投机的好选择,但如果把握好

Speculating with calls on large Canadian banks is usually not a 买入时机,低水平的隐含波动率也可能带来大收益。

sexy prospect, but low implied volatilities can be a boon for

well-timed purchases.

CCFA JOURNAL OF FINANCE February 2022

Page 37 第37页