Page 36 - CCFA Journal - Sixth Issue

P. 36

Market 市场分析 加中金融

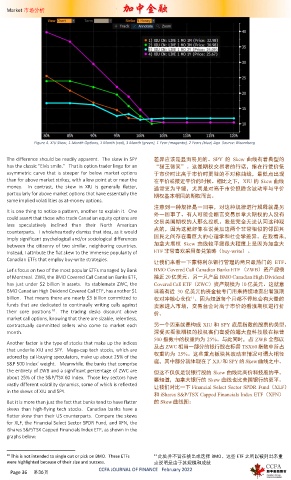

Figure 4. XIU Skew, 1-Month Options, 1 Month (red), 3 Month (green), 1 Year (magenta), 2 Years (blue) Ago Source: Bloomberg

The difference should be readily apparent. The skew in SPY 差异应该是显而易见的。SPY 的 Skew 曲线有着典型的

has the classic “Elvis smile.” That is option trader lingo for an “猫王微笑”。这是期权交易者的行话,指在行使价低

asymmetric curve that is steeper for below market options 于市价时比高于市价时更陡的不对称曲线,最低点出现

than for above market strikes, with a low point at or near the 在平价或接近平价的时候。相比之下,XIU 的 Skew 曲线

money. In contrast, the skew in XIU is generally flatter, 通常更为平缓,尤其是对高于市价但隐含波动率与平价

particularly for above market options that have essentially the 期权基本相同的期权而言。

same implied volatilities as at-money options.

注意到一种规律是一回事,对这种规律进行解释就是另

It is one thing to notice a pattern, another to explain it. One 外一回事了。有人可能会断言交易加拿大期权的人没有

could assert that those who trade Canadian equity options are 交易美国期权的人那么投机。我是完全无法认同这种观

less speculatively inclined than their North American

counterparts. I wholeheartedly dismiss that idea, as it would 点的,因为这就好像在说美加这两个非常相似的邻国其

imply significant psychological and/or sociological differences 国民之间存在着巨大的心理学和社会学差异。在我看来,

between the citizenry of two similar, neighboring countries. 加拿大期权 Skew 曲线较平缓很大程度上是因为加拿大

Instead, I attribute the flat skew to the immense popularity of ETF 非常喜欢采用备兑策略(buy-write)。

Canadian ETFs that employ buy-write strategies.

让我们来看一下蒙特利尔银行管理的两只最热门的 ETF。

Let’s focus on two of the most popular ETFs managed by Bank BMO Covered Call Canadian Banks ETF (ZWB)资产规模

of Montreal. ZWB, the BMO Covered Call Canadian Banks ETF, 接近 20 亿美元。另一只产品 BMO Canadian High Dividend

has just under $2 billion in assets. Its stablemate ZWC, the Covered Call ETF(ZWC)资产规模为 10 亿美元。这就意

BMO Canadian High Dividend Covered Call ETF, has another $1 味着有近 30 亿美元的资金被专门用来持续地卖出看涨期

billion. That means there are nearly $3 billion committed to 权对冲核心仓位 。因为知道每个月都不停地会有大量的

11

funds that are dedicated to continually writing calls against 卖家进入市场,交易台会对高于市价的看涨期权进行折

their core positions 10 . The trading desks discount above 价。

market call options, knowing that there are sizable, relentless,

contractually committed sellers who come to market each 另一个因素就是构成 XIU 和 SPY 底层指数的股票的类型。

month. 深受买看涨期权的投机客们喜爱的超大盘科技股在标普

500 指数中的权重约为 25%。与此同时,占 ZWB 全部以

Another factor is the type of stocks that make up the indices

that underlie XIU and SPY. Mega-cap tech stocks, which are 及占 ZWC 相当一部分的银行股在标普 TSX60 指数中所占

adored by call-buying speculators, make up about 25% of the 权重约为 25%。这些重点板块其波动率情况可谓大相径

S&P 500 Index’ weight. Meanwhile, the banks that comprise 庭,其中部分就体现在了 XIU和 SPY的 Skew曲线之中。

the entirety of ZWB and a significant percentage of ZWC are 但这不仅仅是说银行股的 Skew 曲线比高价科技股的平。

about 25% of the S&P/TSX 60 Index. Those key sectors have 要知道,加拿大银行的 Skew 曲线也比美国银行的更平。

vastly different volatility dynamics, some of which is reflected 让我们对比一下 Financial Select Sector SPDR Fund(XLF)

in the skews of XIU and SPY.

和 iShares S&P/TSX Capped Financials Index ETF(XFN)

But it is more than just the fact that banks tend to have flatter 的 Skew 曲线图:

skews than high-flying tech stocks. Canadian banks have a

flatter skew than their US counterparts. Compare the skews

for XLF, the Financial Select Sector SPDR Fund, and XFN, the

iShares S&P/TSX Capped Financials Index ETF, as shown in the

graphs below:

10 This is not intended to single out or pick on BMO. These ETFs 11 此处并不旨在挑出或选择 BMO。这些 ETF 之所以被列出来重

were highlighted because of their size and success. 点说明是由于其规模和成就

CCFA JOURNAL OF FINANCE February 2022

Page 36 第36页