Page 24 - CIMA MCS Workbook November 2018 - Day 1 Suggested Solutions

P. 24

CIMA NOVEMBER 2018 – MANAGEMENT CASE STUDY

Dividend cover – NCI N/A

shareholders

Dividend as % of 5.2 / 7.9 65.8%

profit – parent

shareholders

Dividend as % of N/A

profit – NCI

shareholders

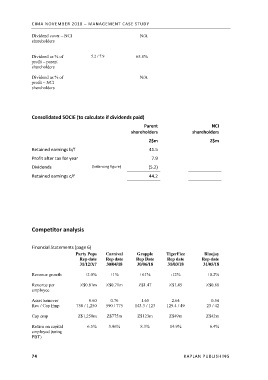

Consolidated SOCIE (to calculate if dividends paid)

Parent NCI

shareholders shareholders

Z$m Z$m

Retained earnings b/f 41.5

Profit after tax for year 7.9

Dividends (balancing figure) (5.2)

Retained earnings c/f 44.2

Competitor analysis

Financial Statements (page 6)

Party Pops Carnival Grapple TigerFizz Bluejay

Rep date Rep date Rep Date Rep date Rep date

31/12/X7 30/04/18 30/06/18 31/03/18 31/05/18

Revenue growth +2.0% +1% +61% -12% +0.2%

Revenue per Z$0.81m Z$0.71m Z$1.47 Z$1.45 Z$0.88

employee

Asset turnover 0.60 0.76 1.65 2.64 0.54

Rev / Cap Emp 750 / 1,250 590 / 775 143.3 / 123 129.4 / 49 23 / 42

Cap emp Z$1,250m Z$775m Z$123m Z$49m Z$42m

Return on capital 6.5% 3.96% 8.3% 14.9% 6.4%

employed (using

PBT)

74 KAPLAN PUBLISHING