Page 28 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 28

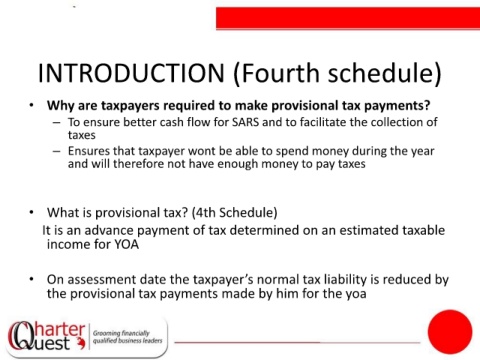

INTRODUCTION (Fourth schedule)

• Why are taxpayers required to make provisional tax payments?

– To ensure better cash flow for SARS and to facilitate the collection of

taxes

– Ensures that taxpayer wont be able to spend money during the year

and will therefore not have enough money to pay taxes

• What is provisional tax? (4th Schedule)

It is an advance payment of tax determined on an estimated taxable

income for YOA

• On assessment date the taxpayer’s normal tax liability is reduced by

the provisional tax payments made by him for the yoa