Page 24 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 24

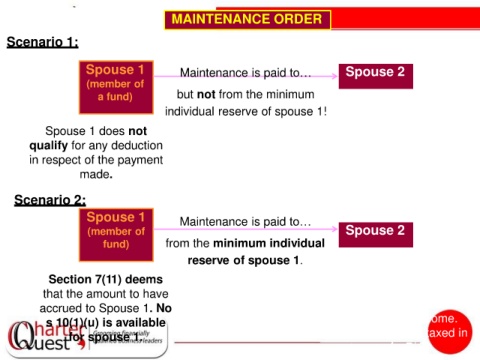

MAINTENANCE ORDER

Scenario 1:

Spouse 1 Maintenance is paid to… Spouse 2

(member of

a fund) but not from the minimum

individual reserve of spouse 1!

Spouse 2 includes amount

Spouse 1 does not in gross income and will

qualify for any deduction qualify for the s 10(1)(u)

in respect of the payment exemption.

made.

Scenario 2:

Spouse 1 Maintenance is paid to…

(member of Spouse 2

fund) from the minimum individual

reserve of spouse 1.

Section 7(11) deems Although spouse 2

that the amount to have physically received the

accrued to Spouse 1. No amount, no inclusion will be

s 10(1)(u) is available made into gross income.

for spouse 1. Spouse 1 is already taxed in

terms of s 7(11).