Page 20 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 20

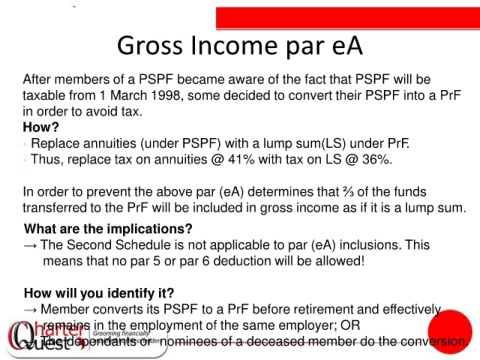

Gross Income par eA

After members of a PSPF became aware of the fact that PSPF will be

taxable from 1 March 1998, some decided to convert their PSPF into a PrF

in order to avoid tax.

How?

- Replace annuities (under PSPF) with a lump sum(LS) under PrF.

- Thus, replace tax on annuities @ 41% with tax on LS @ 36%.

In order to prevent the above par (eA) determines that ⅔ of the funds

transferred to the PrF will be included in gross income as if it is a lump sum.

What are the implications?

→ The Second Schedule is not applicable to par (eA) inclusions. This

means that no par 5 or par 6 deduction will be allowed!

How will you identify it?

→ Member converts its PSPF to a PrF before retirement and effectively

remains in the employment of the same employer; OR

→ The dependants or nominees of a deceased member do the conversion.