Page 16 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 16

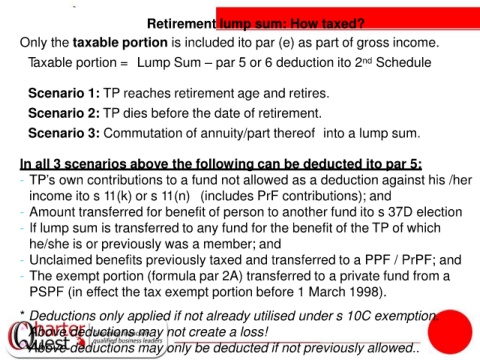

Retirement lump sum: How taxed?

Only the taxable portion is included ito par (e) as part of gross income.

• Taxable portion = Lump Sum – par 5 or 6 deduction ito 2 nd Schedule

• Scenario 1: TP reaches retirement age and retires.

• Scenario 2: TP dies before the date of retirement.

• Scenario 3: Commutation of annuity/part thereof into a lump sum.

In all 3 scenarios above the following can be deducted ito par 5:

- TP’s own contributions to a fund not allowed as a deduction against his /her

income ito s 11(k) or s 11(n) (includes PrF contributions); and

- Amount transferred for benefit of person to another fund ito s 37D election

- If lump sum is transferred to any fund for the benefit of the TP of which

he/she is or previously was a member; and

- Unclaimed benefits previously taxed and transferred to a PPF / PrPF; and

- The exempt portion (formula par 2A) transferred to a private fund from a

PSPF (in effect the tax exempt portion before 1 March 1998).

* Deductions only applied if not already utilised under s 10C exemption.

* Above deductions may not create a loss!

* Above deductions may only be deducted if not previously allowed..