Page 15 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 15

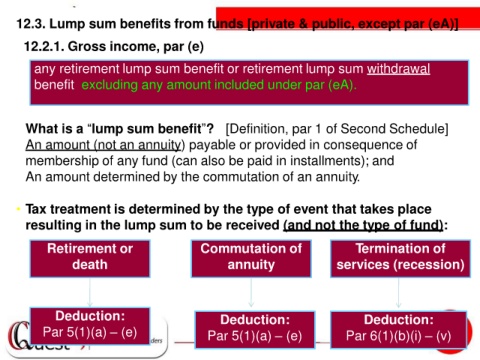

12.3. Lump sum benefits from funds [private & public, except par (eA)]

12.2.1. Gross income, par (e)

any retirement lump sum benefit or retirement lump sum withdrawal

benefit excluding any amount included under par (eA).

• What is a “lump sum benefit”? [Definition, par 1 of Second Schedule]

- An amount (not an annuity) payable or provided in consequence of

membership of any fund (can also be paid in installments); and

- An amount determined by the commutation of an annuity.

• Tax treatment is determined by the type of event that takes place

resulting in the lump sum to be received (and not the type of fund):

Retirement or Commutation of Termination of

death annuity services (recession)

Deduction: Deduction: Deduction:

Par 5(1)(a) – (e) Par 5(1)(a) – (e) Par 6(1)(b)(i) – (v)