Page 10 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 10

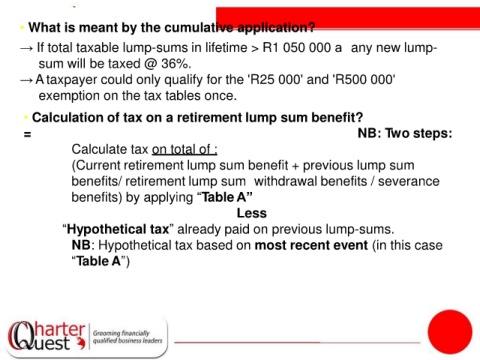

• What is meant by the cumulative application?

→ If total taxable lump-sums in lifetime > R1 050 000 a any new lump-

sum will be taxed @ 36%.

→ A taxpayer could only qualify for the 'R25 000' and 'R500 000'

exemption on the tax tables once.

• Calculation of tax on a retirement lump sum benefit?

= NB: Two steps:

1. Calculate tax on total of :

(Current retirement lump sum benefit + previous lump sum

benefits/ retirement lump sum withdrawal benefits / severance

benefits) by applying “Table A”

Less

2. “Hypothetical tax” already paid on previous lump-sums.

NB: Hypothetical tax based on most recent event (in this case

“Table A”)