Page 9 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 9

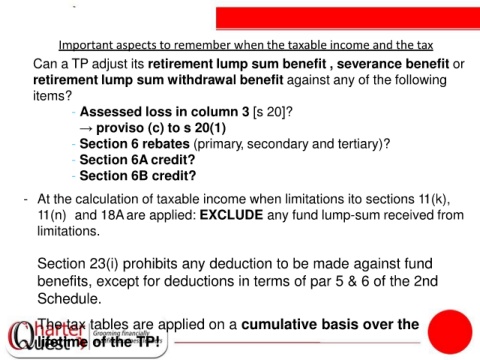

Important aspects to remember when the taxable income and the tax

• Can a TP adjust its retirement lump sum benefit , severance benefit or

retirement lump sum withdrawal benefit against any of the following

items?

- Assessed loss in column 3 [s 20]?

→ proviso (c) to s 20(1)

- Section 6 rebates (primary, secondary and tertiary)?

- Section 6A credit?

- Section 6B credit?

- At the calculation of taxable income when limitations ito sections 11(k),

11(n) and 18Aare applied: EXCLUDE any fund lump-sum received from

limitations.

- Section 23(i) prohibits any deduction to be made against fund

benefits, except for deductions in terms of par 5 & 6 of the 2nd

Schedule.

- The tax tables are applied on a cumulative basis over the

lifetime of the TP!