Page 13 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 13

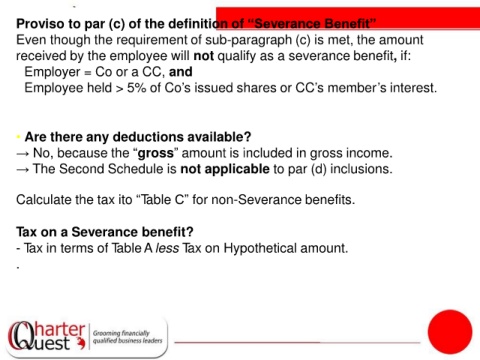

Proviso to par (c) of the definition of “Severance Benefit”

Even though the requirement of sub-paragraph (c) is met, the amount

received by the employee will not qualify as a severance benefit, if:

- Employer = Co or a CC, and

- Employee held > 5% of Co’s issued shares or CC’s member’s interest.

• Are there any deductions available?

→ No, because the “gross” amount is included in gross income.

→ The Second Schedule is not applicable to par (d) inclusions.

Calculate the tax ito “Table C” for non-Severance benefits.

Tax on a Severance benefit?

- Tax in terms of TableA less Tax on Hypothetical amount.

.