Page 18 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 18

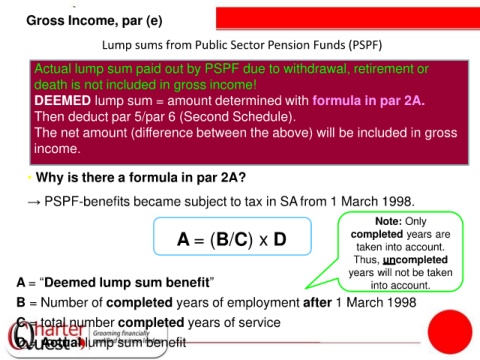

Gross Income, par (e)

Lump sums from Public Sector Pension Funds (PSPF)

Actual lump sum paid out by PSPF due to withdrawal, retirement or

death is not included in gross income!

DEEMED lump sum = amount determined with formula in par 2A.

Then deduct par 5/par 6 (Second Schedule).

The net amount (difference between the above) will be included in gross

income.

• Why is there a formula in par 2A?

→ PSPF-benefits became subject to tax in SA from 1 March 1998.

Note: Only

A = (B/C) x D completed years are

taken into account.

Thus, uncompleted

years will not be taken

A = “Deemed lump sum benefit” into account.

B = Number of completed years of employment after 1 March 1998

C = total number completed years of service

D = Actual lump sum benefit