Page 23 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 23

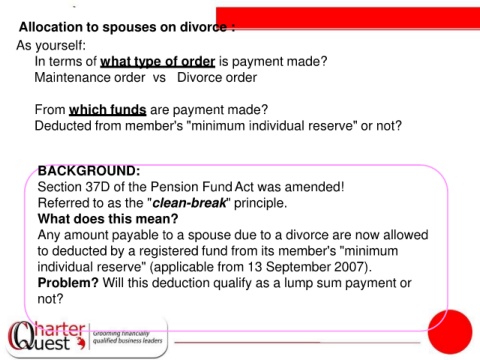

Allocation to spouses on divorce :

As yourself:

1. In terms of what type of order is payment made?

Maintenance order vs Divorce order

2. From which funds are payment made?

Deducted from member's "minimum individual reserve" or not?

BACKGROUND:

Section 37D of the Pension Fund Act was amended!

Referred to as the "clean-break" principle.

What does this mean?

Any amount payable to a spouse due to a divorce are now allowed

to deducted by a registered fund from its member's "minimum

individual reserve" (applicable from 13 September 2007).

Problem? Will this deduction qualify as a lump sum payment or

not?