Page 25 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 25

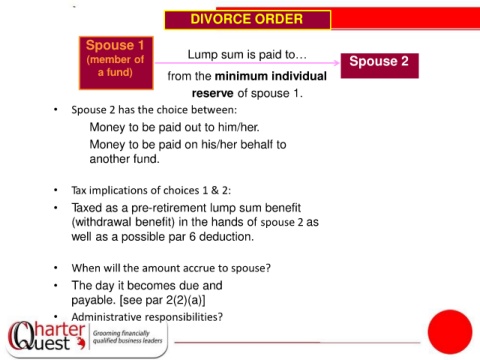

DIVORCE ORDER

Spouse 1

(member of Lump sum is paid to… Spouse 2

a fund) from the minimum individual

reserve of spouse 1.

• Spouse 2 has the choice between:

1. Money to be paid out to him/her.

2. Money to be paid on his/her behalf to

another fund.

• Tax implications of choices 1 & 2:

• Taxed as a pre-retirement lump sum benefit

(withdrawal benefit) in the hands of spouse 2 as

well as a possible par 6 deduction.

• When will the amount accrue to spouse?

• The day it becomes due and

payable. [see par 2(2)(a)]

• Administrative responsibilities?