Page 22 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 22

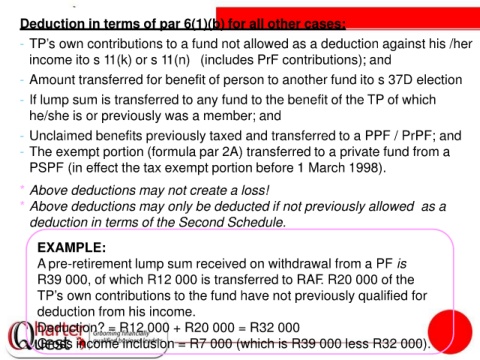

Deduction in terms of par 6(1)(b) for all other cases:

- TP’s own contributions to a fund not allowed as a deduction against his /her

income ito s 11(k) or s 11(n) (includes PrF contributions); and

- Amount transferred for benefit of person to another fund ito s 37D election

- If lump sum is transferred to any fund to the benefit of the TP of which

he/she is or previously was a member; and

- Unclaimed benefits previously taxed and transferred to a PPF / PrPF; and

- The exempt portion (formula par 2A) transferred to a private fund from a

PSPF (in effect the tax exempt portion before 1 March 1998).

* Above deductions may not create a loss!

* Above deductions may only be deducted if not previously allowed as a

deduction in terms of the Second Schedule.

EXAMPLE:

A pre-retirement lump sum received on withdrawal from a PF is

R39 000, of which R12 000 is transferred to RAF. R20 000 of the

TP’s own contributions to the fund have not previously qualified for

deduction from his income.

Deduction? = R12 000 + R20 000 = R32 000

Gross income inclusion = R7 000 (which is R39 000 less R32 000).