Page 19 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 19

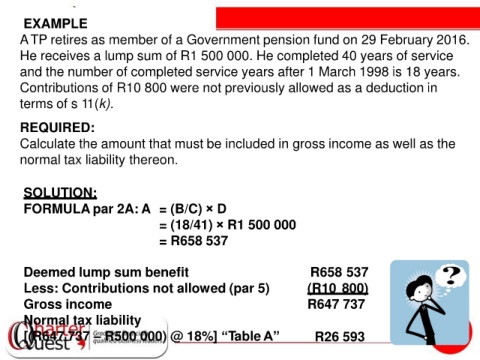

EXAMPLE

ATP retires as member of a Government pension fund on 29 February 2016.

He receives a lump sum of R1 500 000. He completed 40 years of service

and the number of completed service years after 1 March 1998 is 18 years.

Contributions of R10 800 were not previously allowed as a deduction in

terms of s 11(k).

REQUIRED:

Calculate the amount that must be included in gross income as well as the

normal tax liability thereon.

SOLUTION:

FORMULA par 2A: A = (B/C) × D

= (18/41) × R1 500 000

= R658 537

Deemed lump sum benefit R658 537

Less: Contributions not allowed (par 5) (R10 800)

Gross income R647 737

Normal tax liability

[(R647 737 – R500 000) @ 18%] “Table A” R26 593