Page 14 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 14

12.2. Lump sums from employers

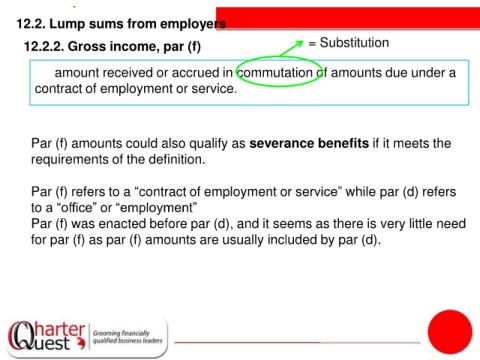

12.2.2. Gross income, par (f) = Substitution

An amount received or accrued in commutation of amounts due under a

contract of employment or service.

- Par (f) amounts could also qualify as severance benefits if it meets the

requirements of the definition.

- Par (f) refers to a “contract of employment or service” while par (d) refers

to a “office” or “employment”

- Par (f) was enacted before par (d), and it seems as there is very little need

for par (f) as par (f) amounts are usually included by par (d).